Highlights

- This report provides information on unaudited spending by the Province through the end of the 2022-23 fiscal year (March 31, 2023).

- The information in this report is based on the FAO’s analysis of transactions recorded in the Province’s Integrated Financial Information System (IFIS) as of April 24, 2023. All figures are unaudited, as final audited figures are not available until the release of the Public Accounts of Ontario after the end of the fiscal year.

2022-23 Spending Plan

- The Province’s yearly spending plan represents the legal spending authority for ministries as granted by the Legislature through the process of supply.[1] The Province started the 2022-23 fiscal year with a spending plan of $193.0 billion.[2]

Changes to the 2022-23 Spending Plan

- The Province may change its spending plan throughout the year, either by requesting additional spending authority from the Legislature or by reallocating spending among different programs through Treasury Board Orders.

- By the end of the fiscal year, March 31, 2023, the Province’s spending plan was up $1,294 million, reaching $194.3 billion.

- By sector, the largest spending plan increase during the fiscal year was in ‘other programs,’ at $4,208 million, followed by justice ($189 million) and education ($128 million). The remaining program sectors experienced spending plan decreases during the 2022-23 fiscal year: health (-$312 million), postsecondary education (-$116 million) and children’s and social services (-$65 million).

- The largest program change was a $5,000 million increase for Ministry of Indigenous Affairs, Land Claims and Self-Government Initiatives for the Province’s contribution to the proposed $10 billion settlement agreement between the governments of Ontario and Canada and 21 Robinson Huron First Nations over unpaid annuities.

Actual Unaudited Spending vs. Planned Spending

- Although the Province increased its 2022-23 spending plan by $1,294 million to $194.3 billion, by the end of 2022-23, actual unaudited spending was only $187.1 billion. Overall, this was $7.2 billion (3.7 per cent) less than planned. The $7.2 billion in below-planned spending (or net savings) will be used to reduce both the budget deficit and Ontario’s net debt.

- All sectors spent less than planned, led by ‘other programs’ (-$2,407 million, 6.4 per cent), health (‑$1,693 million, 2.2 per cent), interest on debt (-$452 million, 3.5 per cent), postsecondary education (‑$277 million, 4.0 per cent), children’s and social services (-$275 million, 1.5 per cent), justice (-$163 million, 2.7 per cent) and education (-$141 million, 0.4 per cent).

- Programs with the largest less-than-planned spending include Treasury Board Secretariat, employee and pension benefits (-$423 million), the COVID-19 Response program (-$341 million), the operation of hospitals (-$279 million), Metrolinx infrastructure projects (-$254 million), drug programs (-$239 million), major hospital infrastructure projects (-$187 million), student financial aid (-$141 million), and municipal transit infrastructure projects (-$117 million).

- For information on spending by all of the Province’s programs and ministries, visit the FAO’s website at: https://tinyurl.com/3mfpmnhj.

2022-23 Spending vs. 2021-22 Spending

- This report also compares 2022-23 actual unaudited spending against 2021-22 actual audited spending to provide context for provincial spending trends and to identify significant year-over-year spending changes.

- Spending in the 2022-23 fiscal year was $6.6 billion (3.7 per cent) higher than in 2021-22.

- The largest year-over-year spending increase was in education ($2,496 million, 7.7 per cent), followed by ‘other programs’ ($2,114 million, 6.3 per cent), children’s and social services ($915 million, 5.3 per cent), interest on debt ($789 million, 6.7 per cent), justice ($256 million, 4.6 per cent) and postsecondary education ($103 million, 1.6 per cent). Conversely, health sector spending in 2022-23 was $37 million less than in 2021-22.

- Programs with the largest year-over-year spending increases include negotiated settlements for Indigenous land claims ($5,000 million), child care ($1,213 million), payments to physicians ($1,015 million), operating funding for school boards ($564 million net increase), the operation of long-term care homes ($362 million) and Ontario Works – Financial Assistance ($324 million).

2022-23 Budget Balance Projection

- Based on the spending information presented in this report and the FAO’s most recent revenue and spending forecasts,[3] the FAO projects a small budget surplus in 2022-23 of $37 million. This is an improvement of $2.2 billion compared to the Province’s deficit projection of $2.2 billion in the 2023 Ontario Budget.

- The FAO estimates that 2022-23 total revenue will be $3.3 billion lower and total consolidated expense will be $5.5 billion lower than forecast by the Province in the 2023 budget. The difference between the two forecasts largely reflects more up-to-date information available to the FAO, which includes more recent spending information.[4]

Status of the Contingency Fund

- The Contingency Fund is used to address spending pressures or fund program changes during the fiscal year. The funds within the Contingency Fund cannot be spent directly by the Province but must be transferred to government programs through Treasury Board Orders.

- The Province started the 2022-23 fiscal year with a total of $4.6 billion in the Contingency Fund. In the second and third quarters, the Province transferred $373 million and $1,302 million, respectively, from the Contingency Fund to various programs. In the fourth quarter, the Province transferred a net $1,064 million from the Contingency Fund to various programs. At year-end, the Contingency Fund had a remaining balance of $1.8 billion which will reduce both the budget deficit and Ontario’s net debt.

Introduction

This report provides information on spending by the Government of Ontario (the Province) through the end of the 2022-23 fiscal year (March 31, 2023). The report:

- identifies changes made to the Province’s 2022-23 spending plan;

- reviews actual unaudited spending in 2022-23 against both the Province’s spending plan and actual spending in 2021-22;

- projects the 2022-23 budget balance; and

- tracks transfers to and from the Province’s Contingency Fund.

The information in this report is based on the FAO’s analysis of transactions recorded in the Province’s Integrated Financial Information System (IFIS) as of April 24, 2023. All figures are unaudited, as final audited figures are not available until the release of the Public Accounts of Ontario up to six months after the end of the fiscal year.

The closing date for spending transactions related to the 2022-23 fiscal year, which ended on March 31, 2023, was April 24, 2023. However, there will still be 2022-23 spending transactions that are recorded between April 24, 2023 and when the 2022-23 Public Accounts of Ontario are released. Depending on these transactions, the 2022-23 Public Accounts of Ontario may contain material changes from the information presented in this report.

2022-23 Spending Plan

The Province’s yearly spending plan represents the legal spending authority for ministries as granted by the Legislature through the process of supply.[5] The Province started the 2022-23 fiscal year with a spending plan of $193.0 billion.[6]

Changes to the 2022-23 Spending Plan

The Province may change its spending plan throughout the year, either by requesting additional spending authority from the Legislature or by reallocating spending among different programs through Treasury Board Orders. By the end of the fiscal year, March 31, 2023, the Province’s spending plan was up $1,294 million, from $193.0 billion to $194.3 billion.

By sector, the largest spending plan increase during the fiscal year was in ‘other programs,’ at $4,208 million, followed by justice ($189 million) and education ($128 million). The remaining program sectors experienced spending plan decreases during the 2022-23 fiscal year: health (-$312 million), postsecondary education (‑$116 million) and children’s and social services (-$65 million).

The Province started the 2022-23 fiscal year with a total of $4.6 billion in unallocated funds in the Contingency Fund. After accounting for net transfers to various programs during the year of $2.7 billion, the remaining Contingency Fund balance at the end of 2022-23 was $1.8 billion. The remaining funds in the Contingency Fund will reduce both the budget deficit and Ontario’s net debt.

| Sector | 2022-23 Spending Plan | Q1 Changes | Q2 Changes | Q3 Changes | Q4 Changes | Total Changes | Revised 2022-23 Spending Plan |

|---|---|---|---|---|---|---|---|

| Health | 75,643 | - | -14 | 183 | -481 | -312 | 75,331 |

| Education | 34,748 | - | 371 | 3 | -246 | 128 | 34,876 |

| Postsecondary Education | 7,061 | - | - | - | -116 | -116 | 6,945 |

| Children's and Social Services | 18,562 | - | 1 | 146 | -212 | -65 | 18,497 |

| Justice | 5,781 | - | 2 | 42 | 145 | 189 | 5,969 |

| Other Programs | 33,658 | - | 13 | 1,137 | 3,058 | 4,208 | 37,866 |

| Unallocated Funds: | |||||||

| Contingency Fund | 4,550 | - | -373 | -1,302 | -1,064 | -2,738 | 1,812 |

| Interest on Debt | 12,988 | - | - | - | - | - | 12,988 |

| Total | 192,992 | 0 | 0 | 209 | 1,085 | 1,294 | 194,286 |

Fourth Quarter Analysis

This section highlights key fourth quarter spending plan changes by sector and vote-item. For information on all of the Province’s transfer payment programs and ministries, visit the FAO’s website at: https://tinyurl.com/3mfpmnhj.

Health: $481 million decrease. Notable changes include:

- $561 million increase for Programs and Administration (Vote-Item 1416-2), including $321 million for Cancer Treatment and Renal Services and $158 million for Digital Health.

- $225 million increase for Ontario Health Insurance (Vote-Item 1405-1), largely for payments to physicians.

- $168 million increase for Emergency Health Services (Vote-Item 1412-2), including $135 million for Payments for Ambulance and related Emergency Services: Municipal Ambulance.

- $200 million decrease for Health Capital (Vote-Item 1407-1), largely for Major Hospital Projects.

- $235 million decrease for Health Services (Vote-Item 1416-1), largely for Community Mental Health.

- $333 million decrease for Provincial Programs (Vote-Item 1412-1), largely for Community and Priority Services.

- $504 million decrease for Population and Public Health (Vote-Item 1406-4), largely for the COVID-19 Response program.

Education: $246 million decrease. Notable changes include:

- $149 million decrease for Policy Development and Program Delivery (Vote-Item 1004-1), including a $175 million decrease for the Child Care and Early Years program.

- $154 million decrease for Support for Elementary and Secondary Education (Capital) (Vote-Item 1002‑3), largely for School Board Capital Grants.

Postsecondary Education: $116 million decrease. Notable changes include:

- $92 million decrease for Colleges, Universities and Student Support (Vote-Item 3002-1), including a $172 million decrease for Student Financial Assistance Programs, partially offset by a $99 million increase for Grants for University Operating Costs.

Children’s and Social Services: $212 million decrease. Notable changes include:

- $123 million decrease for the Ontario Child Benefit (Vote-Item 702-22).

- $206 million decrease for Financial and Employment Supports (Vote-Item 702-3), including a $119 million decrease for Ontario Disability Support Program – Financial Assistance and a $107 million decrease for the Ontario Drug Benefit Plan.

Justice: $145 million increase. Notable changes include:

- $136 million increase for Ministry Administration (Vote-Item 2601-1).

- $102 million increase for statutory spending in the Legal Services Program (Vote 304).

- $91 million increase for Institutional Services (Vote-Item 2605-3) for the operation of Ontario’s correctional institutions for incarcerated adults.

- $103 million decrease for Legal Aid Ontario (Vote-Item 303-2).

- $138 million decrease for transportation and communications spending in Emergency Services Telecommunications (Vote-Item 2614-1).

Other Programs: $3,058 million increase. Notable changes include:

- $5,023 million increase for Ministry of Indigenous Affairs, Land Claims and Self-Government Initiatives (Vote-Item 2001-2) primarily for the Province’s contribution to the proposed $10 billion settlement agreement between the governments of Ontario and Canada and 21 Robinson Huron First Nations over unpaid annuities.

- $263 million increase for Ministry of Transportation, Agency Oversight and Partnerships (operating) (Vote-Item 2702-2), including $281 million for Metrolinx Operating Subsidies.

- $217 million increase for statutory spending on personal protective equipment (PPE) and supplies in Ministry of Government and Consumer Services, Ontario Shared Services (Vote 1811).

- $115 million increase for Ministry of Transportation, Transportation Safety (Vote-Item 2703-1).

- $318 million decrease for Ministry of Energy, Electricity Price Mitigation Programs (Vote-Item 2905-1), largely for the Ontario Electricity Rebate.

- $850 million decrease for Ministry of Infrastructure, Infrastructure Programs (Vote-Item 4003-2), including a $518 million decrease for Broadband and Cellular Infrastructure.

- $1,387 million decrease for Ministry of Transportation, Agency Oversight and Partnerships (capital) (Vote-Item 2702-3), including a $1,056 million decrease for Metrolinx (Capital) and a $370 million decrease for Municipal Transit (Capital).

- A net $4 million decrease for 183 additional vote-items in the ‘other programs’ sector. For more information, visit the FAO’s website at: https://tinyurl.com/3mfpmnhj.

Actual Unaudited Spending

Actual Unaudited Spending vs. Planned Spending

The Province’s 2022-23 spending plan was $194.3 billion. However, actual unaudited spending was $187.1 billion. This was $7.2 billion (3.7 per cent) less than planned.

| Sector | Revised 2022-23 Spending Plan | 2022-23 Unaudited Spending | Unaudited Spending vs. Revised Spending Plan | Unaudited Spending vs. Revised Spending Plan (%) |

|---|---|---|---|---|

| Health | 75,331 | 73,638 | -1,693 | -2.2% |

| Education | 34,876 | 34,736 | -141 | -0.4% |

| Postsecondary Education | 6,945 | 6,669 | -277 | -4.0% |

| Children's and Social Services | 18,497 | 18,222 | -275 | -1.5% |

| Justice | 5,969 | 5,807 | -163 | -2.7% |

| Other Programs | 37,866 | 35,459 | -2,407 | -6.4% |

| Unallocated Funds: | ||||

| Contingency Fund | 1,812 | - | -1,812 | N/A |

| Interest on Debt | 12,988 | 12,536 | -452 | -3.5% |

| Total | 194,286 | 187,065 | -7,221 | -3.7% |

In 2022-23, all sectors spent less than planned. By sector, lower-than-planned spending was led by ‘other programs’ (-$2,407 million, 6.4 per cent), health (-$1,693 million, 2.2 per cent), interest on debt (-$452 million, 3.5 per cent), postsecondary education (-$277 million, 4.0 per cent), children’s and social services (-$275 million, 1.5 per cent), justice (-$163 million, 2.7 per cent) and education (-$141 million, 0.4 per cent). Also, an unspent $1.8 billion end-of-year balance remained in the Contingency Fund. The $7.2 billion in below-planned spending (or net savings) will be used to reduce both the budget deficit and Ontario’s net debt.

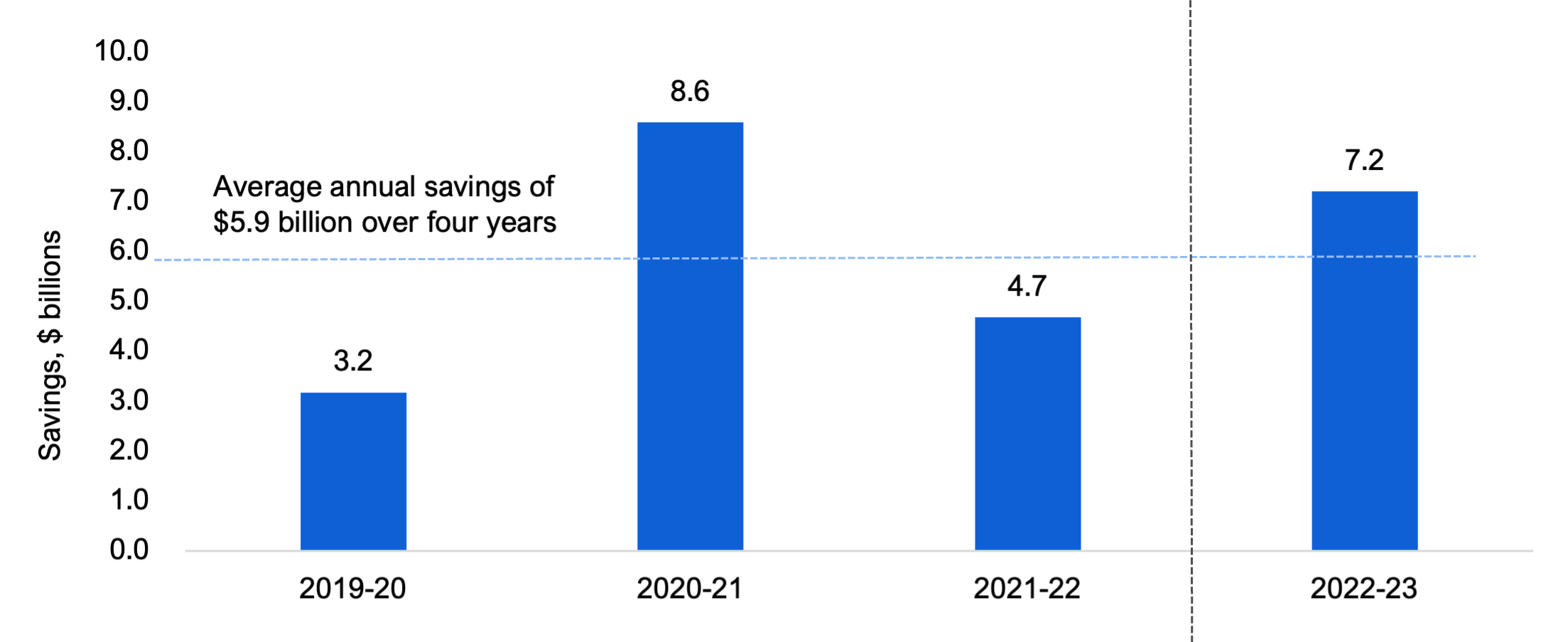

For context, the $7.2 billion (3.7 per cent) in net savings for 2022-23 is higher than the net savings recorded in 2021-22 of $4.7 billion (2.5 per cent) but less than the net savings recorded in 2020-21 of $8.6 billion (4.6 per cent). Over the four-year period from 2019-20 to 2022-23, the Province averaged annual savings of $5.9 billion (3.2 per cent).[7]

Figure 1 Planned spending less actual spending, 2019-20 to 2022-23, $ billions

Note: From 2019-20 to 2021-22, annual savings is calculated as the revised spending plan less actual spending from the Public Accounts of Ontario. For 2022-23, savings is calculated as the revised spending plan less actual unaudited spending as of April 24, 2023. Figures exclude planned and actual spending on some assets and additional spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices.

Source: FAO analysis of information provided by Treasury Board Secretariat and the Public Accounts of Ontario

The rest of this section highlights key vote-item spending that was above and below plan in 2022-23. For information on spending by all of the Province’s programs and ministries, visit the FAO’s website at: https://tinyurl.com/3mfpmnhj.

Health sector spending: $1,693 million (2.2 per cent) less than planned. Highlights include:

- $84 million less than planned in Long-Term Care Program (Capital) (Vote-Item 4502-2), which provides capital funding to long-term care homes.

- $198 million less than planned in Health Capital Program (Vote-Item 1407-1), which provides capital funding to hospitals and other health care facilities.

- $239 million less than planned in Drug Programs (Vote-Item 1405-2).

- $416 million less than planned in Population and Public Health (Vote-Item 1406-4), which is mainly driven by $341 million in lower-than-planned spending for the COVID-19 Response program.

- $435 million less than planned in Health Services (Vote-Item 1416-1), including $279 million less than planned for the Operation of Hospitals and $137 million less than planned for Home Care.

Postsecondary education sector spending: $277 million (4.0 per cent) less than planned. Highlights include:

- $182 million less than planned in Colleges, Universities and Student Support (Vote-Item 3002-1), including $141 million less than planned for financial aid for students.

Children’s and social services sector spending: $275 million (1.5 per cent) less than planned. Highlights include:

- $138 million less than planned in Financial and Employment Supports (Vote-Item 702-3), including $86 million less than planned for Ontario Works – Financial Assistance.

- $104 million less than planned in Support to Individuals and Families (Vote-Item 702-21), including $68 million less than planned for Supportive Services.

Justice sector spending: $163 million (2.7 per cent) less than planned across a number of programs.

Other programs sector spending: $2,407 million (6.4 per cent) less than planned. Highlights include:

- $112 million less than planned in Ministry of Energy, Electricity Price Mitigation (Vote-Item 2905-1), including $80 million less than planned for the Ontario Electricity Rebate.

- $148 million less than planned in Ministry of Labour, Training and Skills Development, Employment Standards (Vote-Item 1605-1), largely for the COVID-19 Worker Income Protection Benefit.

- $388 million less than planned in Ministry of Transportation, Agency Oversight and Partnerships (Capital) (Vote-Item 2702-3), which mainly provides capital funding for Metrolinx and municipal transit infrastructure projects.

- $423 million less than planned for Treasury Board Secretariat, Employee and Pensioner Benefits, Employer Share (Vote 3403).

- A net $1,336 million[8] less than planned in the remaining 295 vote-items in the ‘other programs’ sector. For more information, visit the FAO’s website at: https://tinyurl.com/3mfpmnhj.

2022-23 Spending vs. 2021-22 Spending

This report also compares 2022-23 actual unaudited spending against 2021-22 actual audited spending to provide context for provincial spending trends and to identify significant year-over-year spending changes.

As noted above, the Province spent $187.1 billion in 2022-23. This was $6.6 billion (3.7 per cent) more than was spent in 2021-22. The largest year-over-year spending increase was in education ($2,496 million, 7.7 per cent), followed by ‘other programs’ ($2,114 million, 6.3 per cent), children’s and social services ($915 million, 5.3 per cent), interest on debt ($789 million, 6.7 per cent), justice ($256 million, 4.6 per cent) and postsecondary education ($103 million, 1.6 per cent). Conversely, health sector spending in 2022-23 was $37 million less than in 2021-22.

| Sector | 2022-23 Unaudited Spending | 2021-22 Actual Spending | 2022-23 vs. 2021-22 | 2022-23 vs. 2021-22 (%) |

|---|---|---|---|---|

| Health | 73,638 | 73,674 | -37 | 0.0% |

| Education | 34,736 | 32,239 | 2,496 | 7.7% |

| Postsecondary Education | 6,669 | 6,565 | 103 | 1.6% |

| Children's and Social Services | 18,222 | 17,307 | 915 | 5.3% |

| Justice | 5,807 | 5,551 | 256 | 4.6% |

| Other Programs | 35,459 | 33,345 | 2,114 | 6.3% |

| Interest on Debt | 12,536 | 11,747 | 789 | 6.7% |

| Total | 187,065 | 180,429 | 6,637 | 3.7% |

- The health sector spent $37 million (-0.0 per cent) less in 2022-23 compared to 2021-22, largely due to lower spending for:

- the Operation of Hospitals (-$156 million);

- Major Hospitals Projects (-$242 million);

- Long-Term Care Homes – Capital (-$460 million); and

- Population and Public Health (Vote-Item 1406-4) (-$1,650 million), including $1,184 million less for the COVID-19 Response program;

- payments to physicians ($1,015 million);

- the operation of long-term care homes ($362 million);

- Home Care ($237 million);

- Drug Programs (Vote-Item 1405-2) ($229 million);

- Cancer Treatment and Renal Services ($212 million);

- Clinical Education ($121 million); and

- Digital Health ($76 million).

- The education sector spent $2,496 million (7.7 per cent) more in 2022-23 compared to 2021-22, largely due to higher spending for:

- the Child Care and Early Years program ($1,213 million), which includes the Province’s commitment to provide an average of $10-a-day child care by 2025;[9]

- School Board Operating Grants and Education Property Tax Non-Cash Expense ($940 million);

- School Board Capital Grants ($407 million);

- Priority and Partnerships Funding – Third Parties ($369 million); and

- the Ontario Child Care Tax Credit ($184 million);

- the Investing in Canada Infrastructure Program (-$244 million); and

- Priority and Partnerships Funding – School Boards (-$376 million).

- The postsecondary education sector spent $103 million (1.6 per cent) more in 2022-23 compared to 2021-22, largely due to higher spending on Student Financial Assistance Programs ($64 million).

- The children’s and social services sector spent $915 million (5.3 per cent) more in 2022-23 compared to 2021-22, largely due to higher spending on Ontario Works – Financial Assistance ($324 million), Ontario Disability Support Program – Financial Assistance ($150 million), Residential Services ($123 million) and Supportive Services ($104 million).

- The justice sector spent $256 million (4.6 per cent) more in 2022-23 compared to 2021-22, largely due to higher spending for:

- Emergency Services Telecommunications (Vote-Item 2614-1) ($128 million);

- Institutional Services (Vote-Item 2605-3) ($75 million); and

- Community Safety and Policing Grant and Miscellaneous Grants – Policing Services ($60 million);

- Legal Aid Ontario (-$102 million).

- The other programs sector spent $2,114 million (6.3 per cent) more in 2022-23 compared to 2021-22, largely due to higher spending for:

- Ministry of Indigenous Affairs, Negotiated Settlements for the Province’s contribution to the proposed $10 billion settlement agreement between the governments of Ontario and Canada and 21 Robinson Huron First Nations over unpaid annuities ($5,000 million);

- Ministry of Transportation, Municipal Transit operating subsidies ($255 million);

- Ministry of Municipal Affairs and Housing, Priority Projects for Municipalities and Municipal Organizations, to support the City of Toronto’s 2022 budget shortfall ($235 million);

- Ministry of Finance, Bad Debt Expense (Vote 1209) ($147 million); and

- Ministry for Seniors and Accessibility, Ontario Seniors Care at Home Tax Credit ($140 million);

- Ministry of Northern Development, Mines, Natural Resources and Forestry, Environmental Remediation, which adjusts the Province’s contaminated mine sites liability (-$97 million);

- Ministry of Municipal Affairs and Housing, the Housing Lands – Sale program, which supports the sale of surplus provincial land for affordable housing (-$108 million);

- Ministry of Energy, Energy Support, Engagement and Indigenous Partnership Programs, due to the conclusion of temporary COVID-19-related supports (-$113 million);

- Ministry of Labour, Training and Skills Development, Ontario COVID-19 Worker Income Protection Benefit (-$113 million);

- Ministry of Indigenous Affairs, Mercury Disability Fund – Trustee, English and Wabigoon River Systems Mercury Contamination Settlement Agreement Act, 1986 (-$134 million);

- Ministry of Northern Development, Mines, Natural Resources and Forestry – Public Protection (Vote-Item 2104-1) (-$144 million);

- Ministry of Transportation, Metrolinx transit infrastructure projects (-$145 million);

- Ministry of Northern Development, Mines, Natural Resources and Forestry – Infrastructure for Natural Resource Management (Vote-Item 2103-3) (-$195 million);

- the Property Tax and Energy Cost Rebate Grants program and the Ontario Business Costs Rebate Program (-$373 million);

- Ministry of Energy, the Ontario Electricity Rebate (-$485 million); and

- Treasury Board Secretariat, Employee and Pensioner Benefits, Employer Share (Vote 3403) (‑$1,303 million).

- Interest on debt spending was $789 million (6.7 per cent) more in 2022-23 compared to 2021-22, due to higher interest rates on provincial borrowing and higher overall provincial debt levels.

2022-23 Budget Balance Projection

Based on the spending information presented in this report and the FAO’s most recent revenue and spending forecasts,[10] the FAO projects a small budget surplus in 2022-23 of $37 million. In comparison, in the 2023 Ontario Budget,[11] the Province projected a 2022-23 budget deficit of $2.2 billion. The difference between the FAO’s surplus projection and the Province’s deficit projection is $2.2 billion. The actual 2022-23 budget balance will be released as part of the 2022-23 Public Accounts of Ontario in September 2023.

The FAO estimates that 2022-23 total revenue will be $3.3 billion lower and total consolidated expense will be $5.5 billion lower than forecast by the Province in the 2023 budget. The difference between the two forecasts largely reflects more up-to-date information available to the FAO, which includes more recent spending information.[12]

| Province | FAO | Difference | |

|---|---|---|---|

| Revenue | 200,402 | 197,065 | -3,337 |

| Consolidated Expense* | |||

| Health | 79,804 | 78,500 | -1,304 |

| Education** | 35,025 | 34,889 | -136 |

| Postsecondary Education | 11,345 | 11,112 | -233 |

| Children’s and Social Services | 18,403 | 18,125 | -278 |

| Justice | 5,501 | 5,301 | -200 |

| Other Programs** | 39,070 | 36,193 | -2,876 |

| Interest on Debt | 13,424 | 12,908 | -516 |

| Total Consolidated Expense | 202,572 | 197,028 | -5,544 |

| Surplus/(Deficit) | -2,170 | 37 | 2,207 |

Status of the Contingency Fund

The Contingency Fund is used to address spending pressures or fund program changes during the fiscal year. The funds within the Contingency Fund cannot be spent directly by the Province but must be transferred to government programs through Treasury Board Orders.

The Province started the 2022-23 fiscal year with a total of $4.6 billion in the Contingency Fund. In the second and third quarters, the Province transferred $373 million and $1,302 million, respectively, from the Contingency Fund to various programs. In the fourth quarter, the Province transferred a net $1,064 million from the Contingency Fund to various programs, which included $5,484 million from the Contingency Fund to various programs and $4,421 million from various programs to the Contingency Fund.

| Opening Balance | Q1 Transfers to Ministries | Q2 Transfers to Ministries | Q3 Transfers to Ministries | Q4 Transfers to Ministries | Q4 Transfers to C-Fund | Balance at Year-End |

|---|---|---|---|---|---|---|

| 4,550 | 0 | -373 | -1,302 | -5,484 | 4,421 | 1,812 |

At year-end, the Contingency Fund had a remaining balance of $1,812 million. The remaining funds in the Contingency Fund will reduce both the budget deficit and Ontario’s net debt.

| Ministry/Program | $ millions | |

|---|---|---|

| Opening Contingency Fund Balance | 4,550 | |

| Less: First Quarter Transfers to Ministries | 0 | |

| Less: Second Quarter Transfers to Ministries | -373 | |

| Less: Third Quarter Transfers to Ministries | -1,302 | |

| Less: Fourth Quarter Transfers to Ministries | ||

| Ministry of Economic Development, Job Creation and Trade | ||

| Economic Development, Job Creation and Trade* | -20 | |

| Ministry of Heritage, Sport, Tourism and Culture Industries | ||

| Ontario Science Centre | -4 | |

| Active Recreation | >-1 | |

| Ministry of Indigenous Affairs | ||

| Negotiated Settlements | -5,000 | |

| Indigenous Affairs, Land Claims and Self-Government Initiatives and Indigenous Affairs Capital Program | -24 | |

| Ministry of Northern Development, Mines, Natural Resources and Forestry | ||

| Northern Development (Capital Asset), Ministry Administration, Environmental Remediation and Northern Economic Development | -175 | |

| Infrastructure for Natural Resource Management (Capital Asset), Infrastructure for Natural Resource Management (Operating Expense), Sustainable Resource Management and Other Programs | -43 | |

| Ministry of the Solicitor General | ||

| Other Programs | -114 | |

| Other Programs Across All Ministries* | -104 | |

| Total Fourth Quarter Transfers to Ministries | -5,484 | |

| Add: Fourth Quarters Transfers to the Contingency Fund from Ministries | ||

| Ministry of the Attorney General | ||

| Legal Aid Ontario | 81 | |

| Ministry of Children, Community and Social Services | ||

| Financial and Employment Supports* | 32 | |

| Ontario Child Benefit* | 119 | |

| Ministry of Colleges and Universities | ||

| Research Operating Costs | 8 | |

| Research Support Capital Expense* | 18 | |

| Colleges, Universities and Student Support (Operating Asset)* | 71 | |

| Colleges, Universities and Student Support* | 90 | |

| Ministry of Economic Development, Job Creation and Trade | ||

| Economic Development, Job Creation and Trade* | 102 | |

| Economic Development, Job Creation and Trade (Operating Asset)* | 90 | |

| Ministry of Education | ||

| Support for Elementary and Secondary Education (Capital) | 94 | |

| Policy Development and Program Delivery* | 149 | |

| Ministry of Energy | ||

| Energy Development and Management (Operating Asset)* | 117 | |

| Electricity Price Mitigation Programs* | 316 | |

| Ministry of the Environment, Conservation and Parks | ||

| Ontario Parks Infrastructure (Capital Asset) | 1 | |

| Ministry of Finance | ||

| Other Programs | 7 | |

| Municipal Support Programs | 20 | |

| Ontario Digital Service | 22 | |

| Tax and Benefits Administration | 27 | |

| Ministry of Government and Consumer Services | ||

| Enterprise Information and Information Technology Services | <1 | |

| Information, Privacy and Archives | <1 | |

| Enterprise Information and Information Technology Services (Capital Asset) | <1 | |

| Other Programs | <1 | |

| Ministry Administration | 2 | |

| Government Services Integration Cluster | 6 | |

| Ontario Shared Services | 18 | |

| Ontario Shared Services (Operating Asset) | 45 | |

| Realty (Capital Asset)* | 81 | |

| Ministry of Health | ||

| Health Capital* | 200 | |

| Population and Public Health* | 200 | |

| Ministry of Heritage, Sport, Tourism and Culture Industries | ||

| Tourism and Culture Capital* | 29 | |

| Agency Programs (Capital Asset)* | 39 | |

| Ministry of Infrastructure | ||

| Infrastructure Programs* | 819 | |

| Ministry of Long-Term Care | ||

| Long-Term Care Homes – Operations* | 77 | |

| Ministry of the Solicitor General | ||

| Emergency Services Telecommunications* | 122 | |

| Emergency Services Telecommunications (Capital Asset)* | 252 | |

| Ministry of Transportation | ||

| Agency Oversight and Partnerships (Capital)* | 900 | |

| Treasury Board Secretariat | ||

| Labour Relations and Compensation* | 18 | |

| Bulk Media Buy* | 41 | |

| Other Programs Across All Ministries* | 206 | |

| Total Fourth Quarter Transfers to the Contingency Fund | 4,421 | |

| Contingency Fund Balance at Year-End | 1,812 |

About this Document

Established by the Financial Accountability Officer Act, 2013, the Financial Accountability Office (FAO) provides independent analysis on the state of the Province’s finances, trends in the provincial economy and related matters important to the Legislative Assembly of Ontario.

This report has been prepared with the benefit of publicly available information and information provided by Treasury Board Secretariat.

All dollar amounts are in Canadian, current dollars (i.e., not adjusted for inflation) unless otherwise noted.

Prepared by: Michelle Gordon (Senior Financial Analyst) and Matthew Stephenson (Manager, Financial Analysis) under the direction of Luan Ngo (Acting Chief Financial Analyst).

Graphical Descriptions

| Fiscal year | Savings ($ billions) | Average savings over four years ($ billions) |

|---|---|---|

| 2019-20 | 3.2 | 5.9 |

| 2020-21 | 8.6 | |

| 2021-22 | 4.7 | |

| 2022-23 | 7.2 |

Footnotes

[1] Temporary spending authority is first granted by the Legislature through the Interim Appropriation Act, with final spending authority then granted through the Supply Act. Permanent spending authority is also granted through other legislation for a limited number of programs.

[2] The $193.0 billion spending plan excludes $5.7 billion in additional planned spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices. The $5.7 billion in additional planned spending is not reviewed in this report as the Province does not actively monitor or control this spending. As well, the $193.0 billion spending plan excludes $1.3 billion in planned spending on operating assets and $4.3 billion in planned spending on capital assets.

[3] For more analysis see FAO, “Economic and Budget Outlook, Spring,” 2023.

[4] The FAO’s spending forecast is primarily based on provincial spending information as of April 24, 2023. The Province’s forecast is based primarily on information available as of February 23, 2023. (2023 Ontario Budget, p. 129.)

[5] Temporary spending authority is first granted by the Legislature through the Interim Appropriation Act, with final spending authority then granted through the Supply Act. Permanent spending authority is also granted through other legislation for a limited number of programs.

[6] The $193.0 billion spending plan excludes $5.7 billion in additional planned spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices. The $5.7 billion in additional planned spending is not reviewed in this report as the Province does not actively monitor or control this spending. As well, the $193.0 billion spending plan excludes $1.3 billion in planned spending on operating assets and $4.3 billion in planned spending on capital assets.

[7] From 2019-20 to 2021-22, annual savings is calculated as the revised spending plan less actual spending from the Public Accounts of Ontario. For 2022-23, savings is calculated as the revised spending plan less actual unaudited spending as of April 24, 2023. Figures exclude planned and actual spending on some assets and additional spending by the broader public sector organizations controlled by the Province (hospitals, school boards and colleges), the Province’s agencies and the legislative offices.

[8] Including a total of $905 million in less than planned spending for three vote-items that was not recorded in the Province’s Integrated Financial Information System (IFIS) as of April 24, 2023, but is expected to be recorded as spending during the finalization of the 2022-23 Public Accounts of Ontario.

[9] For more analysis see FAO, “Ministry of Education: Spending Plan Review,” 2022.

[10] For more analysis see FAO, “Economic and Budget Outlook, Spring,” 2023.

[11] Tabled on March 23, 2023.

[12] The FAO’s spending forecast is primarily based on provincial spending information as of April 24, 2023. The Province’s forecast is based primarily on information available as of February 23, 2023. (2023 Ontario Budget, p. 129.).