Highlights

- At the request of the Standing Committee on Finance and Economic Affairs, the FAO has prepared a summary of the measures implemented in Ontario by the Government of Ontario (the Province) and the Government of Canada (the federal government) in response to the COVID-19 pandemic.

- Overall, the FAO has identified 68 federal government measures and 70 provincial measures for a total of 138 COVID-19 response measures. A complete list of the COVID-19 response measures is available on the FAO’s website at https://bit.ly/3hYXQNN.

- There are 126 federal and provincial direct support measures that will provide Ontario with a net total of $105.6 billion through either increased government spending or reduced government revenue.

- There are 61 federal measures, which will provide Ontario with $102.0 billion, and 65 provincial measures, which will provide $10.8 billion. However, after accounting for $7.2 billion in cash transfers from the federal government to the Province, the net cost to the Province from its direct support measures is only $3.6 billion.

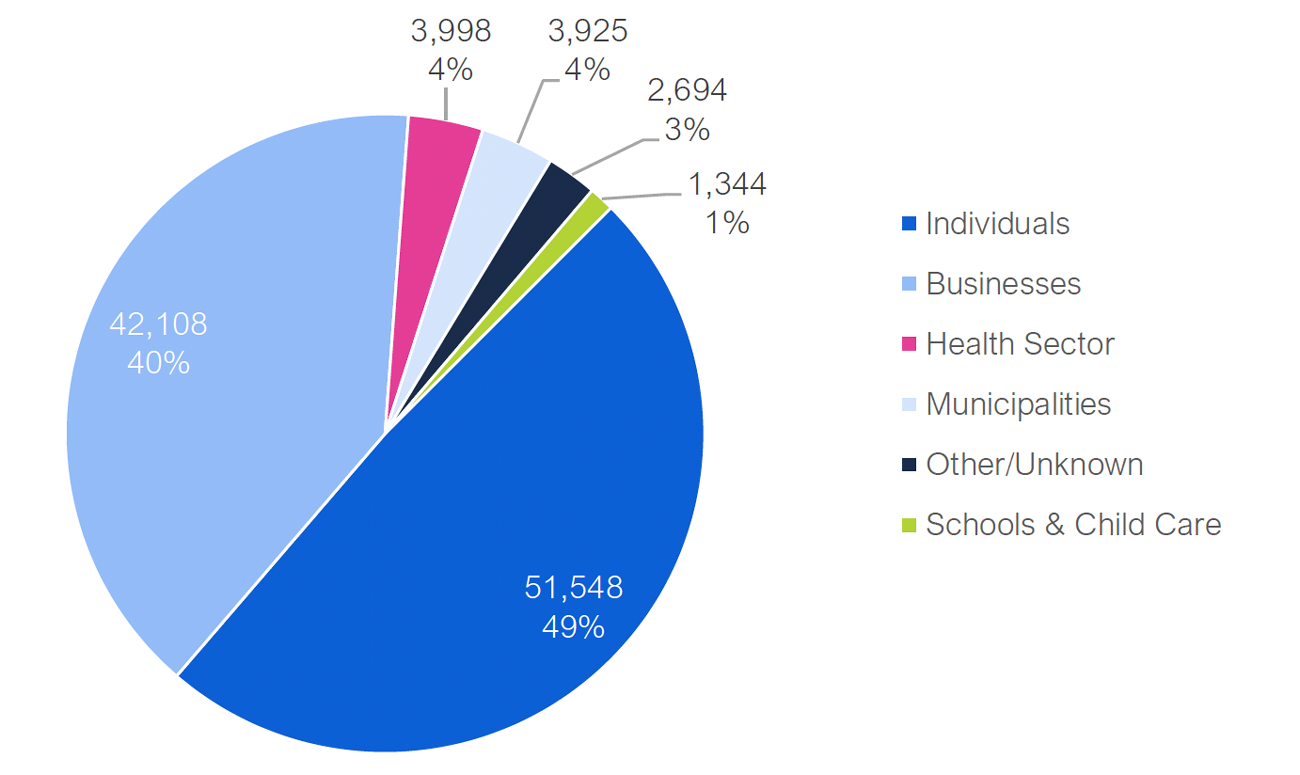

- Most of the direct support measures will benefit individuals ($51.5 billion) and businesses ($42.1 billion) with the remaining support allocated to the health sector ($4.0 billion), municipalities ($3.9 billion), schools and child care ($1.3 billion), and other sectors ($2.7 billion).

- The two largest federal support measures, the Canada Emergency Response Benefit (CERB) and the Canada Emergency Wage Subsidy (CEWS), will provide Ontario with a combined $72.4 billion. These two programs will provide direct payments or wage subsidies that will benefit approximately one-third of working-age Ontarians.

- The FAO identified 18 federal and provincial liquidity measures that will provide Ontario with a net total of $76.9 billion in support mostly through tax deferrals and interest-free loans.

- This includes 11 federal measures, which will provide Ontario with an estimated $66.2 billion in liquidity support, and seven provincial measures, which will provide $10.7 billion in liquidity support.

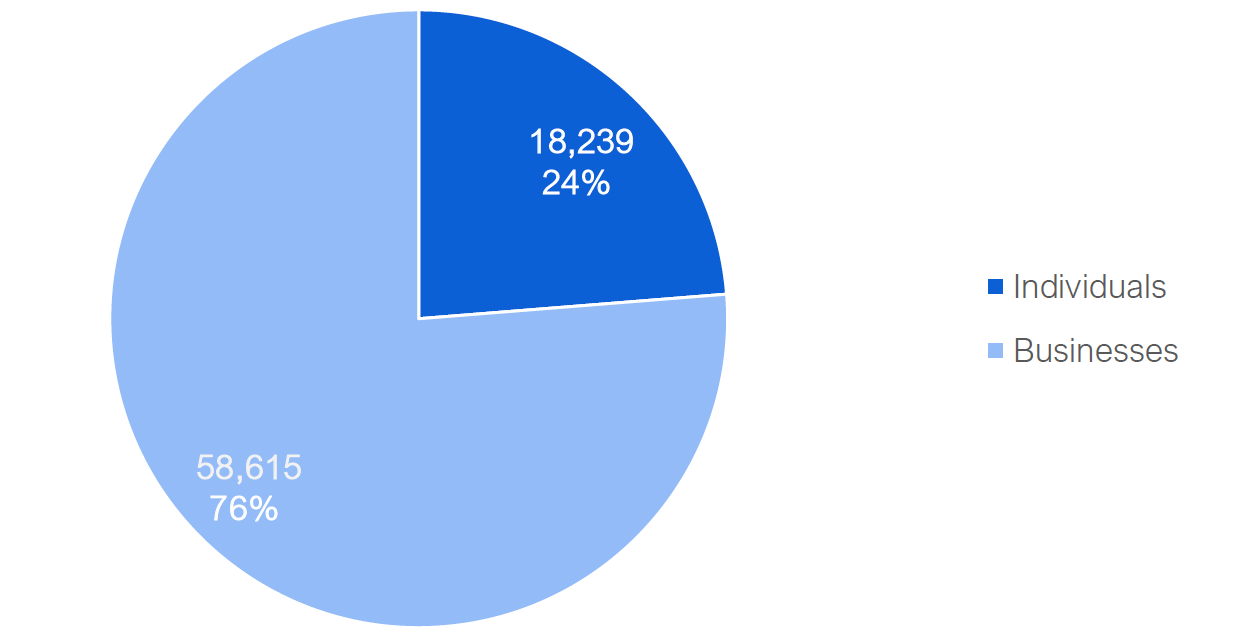

- Of the $76.9 billion in total liquidity support, the FAO estimates $18.2 billion (24 per cent) will benefit individuals, and $58.6 billion (76 per cent) will support businesses.

- The FAO reviewed the status of the Province’s two funds which are available to support COVID-19 response measures: the COVID-19 Health Sector Response Fund (the Health Fund) and Support for People and Jobs Fund (SPJF). In the 2020-21 First Quarter Finances, the Province increased the size of these two funds to a combined $11.1 billion. As of the writing of this report, the FAO estimates that the Province has allocated $4.5 billion from the Health Fund and the SPJF to provincial direct support measures, while $6.7 billion remains unallocated.

- In the 2020-21 First Quarter Finances, the Province presented an Updated Action Plan worth $30.0 billion in total available support in response to the COVID-19 outbreak (includes direct support measures, liquidity measures and unallocated funds in the Health Fund and SPJF). In comparison, the FAO has identified $28.1 billion in available COVID-19 outbreak support.

- The main reason for the $1.9 billion difference is that the FAO excludes spending in the health sector and for electricity price mitigation programs that are not related to the COVID-19 outbreak response. Those expenses are partially offset by new spending announced since the Province’s Updated Action Plan was released that are included in the FAO’s estimate, and differences between the FAO and the Province’s estimated cost of some measures.

Introduction

At the request of the Standing Committee on Finance and Economic Affairs, the FAO has prepared a summary of the measures implemented in Ontario by the Government of Ontario (the Province) and the Government of Canada (the federal government) in response to the COVID-19 pandemic. A complete list of the COVID-19 response measures identified by the FAO is available on the FAO’s website at https://bit.ly/3hYXQNN. The FAO’s list of measures includes:

- for provincial measures: an estimate of the cost of each measure;

- for federal government measures: an estimate of the cost of the support provided to Ontario;

- a description of each measure; and

- the target of support for each measure: either individuals, businesses, municipalities, the health sector, schools and child care, or other/unknown.

Overall, the FAO has identified 68 federal government measures and 70 provincial measures for a total of 138 COVID-19 response measures.[1] The FAO has categorized the measures into direct support measures and liquidity measures. Direct support measures have a direct impact on the respective government’s budget balance through either increased spending (spending measures) or reduced revenue (revenue measures). Liquidity measures provide short-term cash flow support for people and businesses by deferring certain tax payments or providing interest-free loans. Unlike direct support measures, the support provided through liquidity measures must be paid back. Therefore, the cost to the two governments to provide liquidity supports, which includes the cost of borrowing or foregone interest income, is low and will have only a minor impact on budget balances.

This report has three main sections. The first section reviews the federal government’s and Province’s direct support measures, and the second section reviews the liquidity measures provided by both governments. The final section of the report analyzes the Province’s updated $30 billion COVID-19 Response Action Plan.

More information on the development of this report, including data sources and methodology, is available at the end of the report.

Direct Support Measures

Based on the information available to the FAO as of August 26, 2020, the FAO estimates that there are 126 federal and provincial direct support measures[2] that will provide Ontario with a net total of $105.6 billion in support.[3] This includes 61 federal measures, which will provide Ontario with an estimated $102.0 billion, and 65 provincial measures, which will provide $10.8 billion.[4]

However, included in the federal government’s measures are cash transfers to the Province worth an estimated $7.2 billion. This results in a net cost to the Province from its direct support measures of only $3.6 billion. After accounting for federal cash transfers, the federal government’s share of direct support measures is 97 per cent and the provincial government’s share is 3 per cent.

To date, the vast majority of the direct support measures have been spending measures, rather than revenue measures. In total, 115 spending measures will provide estimated net support of $102.4 billion while 11 revenue measures will provide an estimated $3.2 billion in support.

| Estimated Cost of Support in Ontario ($ millions) |

Number of Measures | |

|---|---|---|

| Federal Measures: | ||

| Spending Measures | 99,181 | 56 |

| Revenue Measures | 2,864 | 5 |

| Total Federal Direct Support Measures | 102,045 | 61 |

| Provincial Measures: | ||

| Spending Measures | 10,401 | 59 |

| Revenue Measures | 357 | 6 |

| Total Provincial Direct Support Measures | 10,759 | 65 |

| Less: federal government cash transfers to the Government of Ontario to support provincial measures | -7,187 | |

| Net Total Direct Support Measures | 105,617 | 126 |

Target of Support from Direct Support Measures

The FAO reviewed the 126 direct support measures to determine the target of support based on six categories: individuals, businesses, municipalities (including public transit operations and social services), health sector, schools and child care, and other/unknown.[5]

Of the $105.6 billion in net total direct support measures, the FAO estimates that $93.7 billion, or 89 per cent, will benefit individuals or businesses. Individuals will receive $51.5 billion, primarily through payments to workers and students who have stopped working or are unable to work due to the COVID-19 pandemic. Businesses will receive $42.1 billion, mostly through wage subsidies and forgivable loans paid to businesses that have been affected by the pandemic.

The health sector will receive $4.0 billion mostly for protective equipment and supplies, increases in hospital capacity and infection control in long-term care. Municipalities in Ontario are expected to receive $3.9 billion to support operations, social services and public transit. Schools and child care providers will receive $1.3 billion in funding, mostly to support public health measures at schools and child care centres, as well as for emergency child care for health care workers. Finally, the FAO has identified $2.7 billion in measures that will support other sectors, which includes universities, non-profits, and the COVID-19 pandemic-related operations of Ontario government ministries other than the Ministries of Health and Long-Term Care.[6]

Chart 1 Target of support for direct support measures ($ millions)

Source: FAO analysis of the Government of Canada’s COVID-19 Economic Response Plan, the Parliamentary Budget Office’s Costing of Canada’s COVID-19 Economic Response Plan, the Province’s 2020-21 First Quarter Finances and information provided by Treasury Board Secretariat.

Accessible version

| Target of Support | Estimated Cost in Ontario ($ millions) |

Share of Direct Support Measures (%) |

|---|---|---|

| Individuals | 51,548 | 49 |

| Businesses | 42,108 | 40 |

| Health Sector | 3,998 | 4 |

| Municipalities | 3,925 | 4 |

| Other/Unknown | 2,694 | 2 |

| Schools & Child Care | 1,344 | 1 |

What are the Costliest Direct Support Measures?

The FAO has identified 10 direct support measures with an estimated cost of over $1.0 billion. Together, these 10 measures are estimated to cost $90.9 billion and represent 86 per cent of the total estimated direct support in Ontario.

| Direct Support Measure | Government | Estimated Cost in Ontario ($ millions) |

Share of Direct Support Measures (%) |

Target of Support | Type of Direct Support |

|---|---|---|---|---|---|

| Canada Emergency Response Benefit (CERB) | Federal | 38,400 | 36 | Individuals | Spending |

| Canada Emergency Wage Subsidy (CEWS) | Federal | 33,953 | 32 | Businesses | Spending |

| Canada Emergency Business Account | Federal | 4,983 | 5 | Businesses | Spending / Liquidity |

| Canada Emergency Student Benefit | Federal | 3,159 | 3 | Individuals | Spending |

| Enhanced GST/HST Credit | Federal | 2,166 | 2 | Individuals | Revenue |

| Safe Restart: Support for Public Transit Operators | Federal/Province | 2,000 | 2 | Municipalities | Spending |

| Safe Restart: Direct Federal Spending | Federal | 1,900 | 2 | Other / Unknown | Spending |

| Temporary Pandemic Pay for Eligible Workers | Federal/Province | 1,553 | 1 | Individuals | Spending |

| Changes to Employment Insurance | Federal | 1,392 | 1 | Individuals | Spending |

| Safe Restart: Municipal Operations | Federal/Province | 1,390 | 1 | Municipalities | Spending |

Other Analysis

The Benefit to Ontario from CERB and CEWS

The FAO estimates that $72.4 billion, or 69 per cent, of total direct support will be provided to Ontario through the two largest federal measures, the Canada Emergency Response Benefit (CERB) and the Canada Emergency Wage Subsidy (CEWS). CERB is a program that provides up to $2,000 in taxable benefits every four weeks for up to 28 weeks to individuals who lost employment or are working reduced hours due to the COVID-19 pandemic. As of the writing of this report, over 8.6 million Canadians have received the CERB benefit, 3.4 million, or 40 per cent, of whom reside in Ontario.[7]

CEWS is a program that covers 75 per cent of an employee’s wages, up to $847 per week for eligible employers whose businesses have been affected by the COVID-19 pandemic. In total, 3.0 million Canadian workers have had their wages subsidized by the program, 1.3 million, or 41 per cent, of whom reside in Ontario.[8]

In total, over four million Ontarians have received the CERB benefit or had their wages subsidized through the CEWS program. This represents approximately one-third of the 12 million working-age Ontarians.

Temporary Pandemic Pay for Eligible Workers

Under the Temporary Pandemic Pay for Eligible Workers measure, the Province provided temporary wage increases for eligible health care, long-term care, retirement home, social services and corrections workers. Between April 24 and August 13, 2020, eligible workers received $4 per hour in addition to their hourly wage. Eligible workers also received a lump sum payment of $250 (up to $1,000) if they worked at least 100 hours during one of four designated four-week periods.

Overall, the Province estimates that the program cost $1.6 billion, of which $1.1 billion was provided by the federal government. The Province estimates that $725 million was provided to eligible health care workers, $321 million was provided to eligible workers in long-term care, with the remaining $507 million provided to eligible social services, retirement home and corrections workers.[9]

How Much has Provincial COVID-19 Support Increased since the March 2020 Update?

In the Province’s March 2020 Economic and Fiscal Update (March 2020 Update), the FAO identified $2.6 billion in direct support measures in response to the COVID-19 pandemic.[10] As of the writing of this report, the FAO has identified $10.8 billion in provincial direct support measures, an increase of $8.1 billion. This represents the value of new direct support measures announced by the Province since the March 2020 Update.

| Direct Support Measure | Estimated Cost ($ millions) |

Target of Support |

|---|---|---|

| Support for Public Transit Operators | 2,000 | Municipalities |

| Temporary Pandemic Pay for Eligible Workers | 1,553 | Individuals |

| Funding for Municipal Operations | 1,390 | Municipalities |

| New Health Sector Measures | 1,069 | Health Sector |

| Support for the Safe Re-opening of Schools | 788 | Schools and Child Care |

| Social Services Relief Fund (second & third announcement) | 310 | Municipalities |

| Provincial Contribution to Canada Emergency Commercial Rent Assistance | 241 | Businesses |

| Funding for Child Care Health and Safety Requirements | 235 | Schools and Child Care |

| Other Measures | 554 | Various |

| Total | 8,140 |

Status of Federal Cash Transfers to the Government of Ontario

As previously discussed, the Province’s $10.8 billion in direct support measures are partly funded by federal cash transfers. The Province will receive $7.2 billion in cash transfers from the federal government through four federal streams to support provincial COVID-19 pandemic response measures:

- $0.2 billion through the COVID-19 Response Fund for Provinces and Territories (the Response Fund);

- $1.1 billion through the Essential Workers Wage Top-up;

- $5.1 billion through the Safe Restart Agreement (the Safe Restart Fund);[11] and

- $0.8 billion through the Safe Return to School Fund.

The Response Fund and the Essential Workers Wage Top-up have been fully allocated by the Province to health sector measures and the Temporary Pandemic Pay for Eligible Workers measure, respectively. However, as of the writing of this report, only $2.0 billion of the Safe Restart Fund has been allocated by the Province to specific measures, mainly through the support for public transit operators, municipal operations and child care, leaving approximately to $3.1 billion to be allocated. Additionally, only $0.4 billion of the $0.8 billion Safe Return to School Fund has been allocated to specific measures, leaving almost $0.4 billion remaining to be allocated.

| Total Funds | Funds Allocated to Provincial Measures | Remaining Unallocated Funds | |

|---|---|---|---|

| COVID-19 Response Fund for Provinces and Territories | 194 | 194 | 0 |

| Essential Workers Wage Top-up | 1,129 | 1,129 | 0 |

| Safe Restart Fund | 5,100 | 2,012 | 3,088 |

| Safe Return to School Fund | 763 | 381 | 382 |

| Total | 7,186 | 3,716 | 3,470 |

Importantly, the Province accounts for the remaining $3.5 billion in unallocated federal cash transfers as part of the unallocated funds in the COVID-19 Health Sector Response Fund and the Support for People and Jobs Fund (see next section for more information). There are not separate accounts for the Safe Restart Fund or the Safe Return to School Fund.

Status of Unallocated Provincial Funds

At the start of the 2020-21 fiscal year, the Province’s spending plan included two funds to support COVID-19 response measures: a $1.8 billion COVID-19 Health Sector Response Fund (the Health Fund) and a $2.0 billion Support for People and Jobs Fund (SPJF). In the Province’s 2020-21 First Quarter Finances, the government announced that the two funds would receive top-ups of $4.3 billion and $3.0 billion, respectively, bringing the total Health Fund to $6.2 billion and the SPJF to $5.0 billion.[12]

As of the writing of this report, the FAO estimates that approximately $4.5 billion has been allocated from the two funds to finance the Province’s direct support measures. A combined $6.7 billion remains unallocated in the Health Fund and the SPJF.[13]

| Total Funds | Funds Allocated to Measures | Remaining Unallocated Funds | |

|---|---|---|---|

| COVID-19 Health Sector Response Fund | 6,167 | 1,996 | 4,171 |

| Support for People and Jobs Fund | 4,966 | 2,478 | 2,488 |

| Total | 11,133 | 4,474 | 6,659 |

Liquidity Measures

Based on the information available to the FAO, and as of the writing of this report, the FAO estimates that there are 18 federal and provincial liquidity measures[14] that will provide Ontario with a net total of $76.9 billion in liquidity support.[15] This includes 11 federal measures which will provide Ontario with an estimated $66.2 billion (86 per cent of total) in liquidity support, and seven provincial measures, which will provide $10.7 billion (14 per cent of total) in liquidity support.

| Estimated Liquidity Support in Ontario ($ millions) |

Number of Measures | |

|---|---|---|

| Federal Liquidity Measures | 66,192 | 11 |

| Provincial Liquidity Measures | 10,662 | 7 |

| Total Liquidity Measures | 76,854 | 18 |

Target of Support from Liquidity Measures

The FAO has allocated the 18 liquidity measures into two groups, measures benefiting individuals and measures benefitting businesses. Of the $76.9 billion in total liquidity support, the FAO estimates $18.2 billion will benefit individuals, largely through the extended deadline to file 2019 income tax returns and pay 2019 income tax balances owing, and the 90-day deferral of Education Property Tax payments. The remaining $58.6 billion in liquidity measures will support businesses, largely through the deferral of various taxes and interest-free loans.

Chart 2 Target of support for liquidity measures ($ millions)

Source: FAO analysis of the Government of Canada’s COVID-19 Economic Response Plan, the Parliamentary Budget Office’s Costing of Canada’s COVID-19 Economic Response Plan, the Province’s 2020-21 First Quarter Finances and information provided by Treasury Board Secretariat.

Accessible version

| Target of Support | Estimated Liquidity Support in Ontario ($ millions) |

Share of Total (%) |

|---|---|---|

| Businesses | 58,615 | 76 |

| Individuals | 18,239 | 24 |

What are the Liquidity Measures?

The table below lists 12 liquidity measures for which an estimate of the support provided in Ontario is available. A short description of each measure is available on the FAO website at https://bit.ly/3hYXQNN.

| Liquidity Support Measures | Government | Estimated Liquidity Support in Ontario ($ millions) |

Share of Total (%) |

Target of Support |

|---|---|---|---|---|

| Extended Deadlines to File Income Tax Returns and Pay Income Taxes for Individuals | Federal | 17,366 | 22.6% | Individuals |

| Canada Emergency Business Account (CEBA) | Federal | 14,948 | 19.5% | Businesses |

| Small and Medium-sized Enterprise Loan and Guarantee Program | Federal | 14,737 | 19.2% | Businesses |

| Deferral of Sales Tax Remittance and Customs Duty Payments | Federal | 11,972 | 15.6% | Businesses |

| Deferral of Select Provincially Administered Taxes[16] | Province | 6,671 | 8.7% | Businesses |

| Extended Deadlines to File Income Tax Returns and Pay Income Taxes for Businesses, Trusts and Non-Profits | Federal | 5,875 | 7.6% | Businesses |

| Deferral of Education Property Tax | Province | 1,850 | 2.4% | Individuals/Businesses |

| Deferral of Workplace Safety and Insurance Board (WSIB) Premiums | Province | 1,767 | 2.3% | Businesses |

| Additional Lending Capacity for Farm Credit Canada | Federal | 1,225 | 1.6% | Businesses |

| Deferral of Global Adjustment Charges for Commercial and Industrial Ratepayers | Province | 358 | 0.5% | Businesses |

| Funding for Indigenous Businesses and Aboriginal Financial Institutions | Federal | 69 | 0.1% | Businesses |

| Deferral of Provincial Land Tax | Provincial | 15 | < 0.1% | Individuals/Businesses |

What has changed since the March 2020 Update?

In the Province’s March 2020 Update, the FAO identified $9.0 billion in provincial liquidity measures in response to the COVID-19 pandemic.[17] As of the writing of this report, the FAO has identified $10.7 billion in provincial liquidity measures, an increase of $1.7 billion.

Since the March 2020 Update, the Province has introduced three new liquidity measures: the Deferral of Global Adjustment Charges for Commercial and Industrial Ratepayers ($358 million), the Deferral of Provincial Land Tax in unincorporated areas in Northern Ontario ($15 million) and increased support for Aboriginal Financial Institutions (estimated support not available).

In addition, the Province announced in the 2020-21 First Quarter Finances that the deferral of filing and remittance deadlines for a number of provincially administered taxes would be extended by one month, for a total of six months. The FAO estimates that the one-month extension will provide an additional $1.1 billion in liquidity support to businesses.

A Review of the Province’s Updated COVID-19 Response Action Plan

In the Province’s 2020-21 First Quarter Finances, released on August 12, 2020, the Province presented an Updated Action Plan in response to the COVID-19 outbreak providing $30 billion in total support, with $18.7 billion in direct support (which includes unallocated amounts from the Health Fund and the SPJF) and $11.3 billion in liquidity support.

Overall, the FAO has identified $28.1 billion in available COVID-19 support consisting of provincial direct support measures ($10.8 billion), unallocated COVID-19 funds ($6.7 billion) and provincial liquidity measures ($10.7 billion).

The FAO’s identified available support of $28.1 billion is $1.9 billion less than the Province’s $30 billion Updated Action Plan. The main reason for the $1.9 billion difference is that the Province’s Updated Action Plan continues to include spending in the health sector ($1.2 billion) and for electricity price mitigation programs ($1.5 billion) that are not related to the COVID-19 outbreak response.[18] Those measures are offset by $0.8 billion, which consists of new measures announced since the Province’s Updated Action Plan was released that are included in the FAO’s estimate, and differences between the FAO and the Province’s estimated cost of some measures.

| FAO Identified Measures and Unallocated Funds | Ontario’s $30 Billion Updated Action Plan | |

|---|---|---|

| Provincial Direct Support Measures | 10.8 | 11.2 |

| Remaining Unallocated Provincial Funds | 6.7 | 7.5 |

| Provincial Liquidity Measures | 10.7 | 11.3 |

| Total Available Provincial Support | 28.1 | 30.0 |

| Difference | -1.9 |

Footnotes

[1] This report only identifies measures implemented by the Province and federal government in direct response to the COVID-19 pandemic.

[2] There are six federal and provincial measures that provide both repayable and non-repayable supports. These measures are categorized as both direct support and liquidity measures and are counted towards both types of support.

[3] The complete list of the COVID-19 response measures is available on the FAO’s website at https://bit.ly/3hYXQNN.

[4] In the $10.8 billion total for provincial direct support, the FAO includes specific measures that have been announced. This amount excludes unallocated portions of the Province’s COVID-19 Health Sector Response Fund and Support for People and Jobs Fund. See Status of Unallocated Provincial Funds for more information.

[5] Federal cash transfers to the Province are categorized based on the ultimate beneficiary of the spending.

[6] The other category also includes measures for which the target of support is not yet known.

[7] Government of Canada. Canada Emergency Response Benefit Statistics.

[8] Government of Canada. Canada Emergency Wage Subsidy Claims to Date. Estimate is based on the peak number of workers supported.

[9] Ontario Ministries of Health and Long-Term Care.

[10] Includes spending and revenue measures and excludes unallocated funds. See FAO, “Spending Plan Analysis: 2020-21,” 2020. Total also includes $0.2 billion in spending and revenue measures in 2019-20.

[11] The Safe Restart Agreement provides for an additional $1.9 billion to be directly spent by the federal government in Ontario, mainly for the purchase of a national PPE stockpile.

[12] Note that to increase the amount of funds available in the Health Fund and the SPJF, the Province is required to table Supplementary Estimates in the legislature. These funds must ultimately be approved by Members of Provincial Parliament through the passage of the Supply Act.

[13] The Province’s 2020-21 spending plan also includes unallocated funds in the Contingency Fund. The Contingency Fund began the 2020-21 year with an allocation of $1.3 billion, which was topped-up by $2.2 billion in the 2020-21 First Quarter Finances. After accounting for allocations, the Province reports that the Contingency Fund balance is $2.7 billion.

[14] Excludes liquidity measures provided by the Bank of Canada, the Canada Mortgage and Housing Corporation, and commercial lenders, as well as capital relief provided by the Office of the Superintendent of Financial Institutions.

[15] Total estimated support excludes six liquidity measures for which an estimate is not available. The complete list of the COVID-19 response measures is available on the FAO’s website at https://bit.ly/3hYXQNN.

[16] The provincial taxes that are subject to the deferral are the Employer Health Tax, Tobacco Tax, Fuel Tax, Gas Tax, Beer, Wine and Spirits Taxes, Mining Tax, Insurance Premium Tax, International Fuel Tax Agreement, Retail Sales Tax on Insurance Contracts and Benefit Plans, and Race Tracks Tax.

[17] FAO, “Spending Plan Analysis: 2020-21,” 2020.

[18] The $1.2 billion health sector funding was to maintain existing (pre-COVID-19 outbreak) service levels for hospitals and long-term care homes, and the $1.5 billion spending on electricity price mitigation programs resulted from an updated forecast for existing programs. See FAO, “Spending Plan Analysis: 2020-21,” for more details.