Highlights

- This report provides information on the Province’s 2020-21 spending plan presented in the March 2020 Economic and Fiscal Update (March 2020 Update). The report reviews how the 2020-21 spending plan has changed since the 2019 Ontario Budget, categorizes spending changes and assesses the Province’s Action Plan, which identified $17 billion in new support.[1]

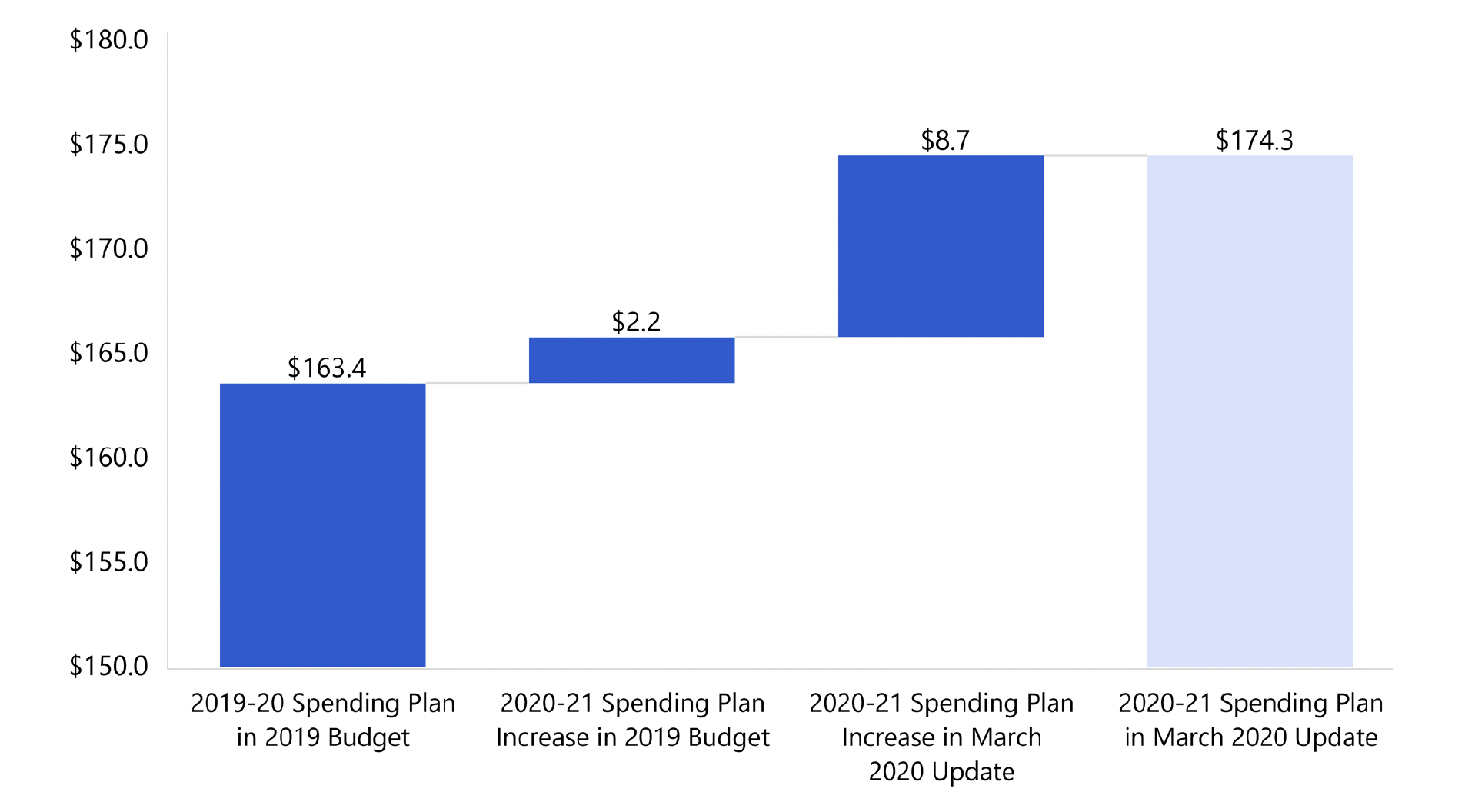

- In the March 2020 Update, the Province outlined a spending plan for 2020-21 of $174.3 billion. This spending plan is up $10.8 billion, or 6.6 per cent, from the 2019-20 spending plan in the 2019 budget.

- The $10.8 billion increase consists of $2.2 billion that was already accounted for at the time of the 2019 budget and $8.7 billion that was added in the March 2020 Update.

- With the additional $8.7 billion:

- The health sector received an additional $3.3 billion, just over one-third of the $8.7 billion spending plan increase.

- The children’s and social services, justice and other programs sectors all received significant funding increases to offset originally planned year-over-year budget decreases.

- The FAO reviewed the $8.7 billion spending plan increase and grouped the new funding into four categories: allocation adjustments to existing programs with no changes to service levels, program changes since the 2019 budget, COVID-19 response spending for identified measures, and unallocated funds. The FAO made the following observations:

- $3.2 billion (or 37 per cent) is for program allocation adjustments with no change in service levels or eligibility. This includes funding to maintain existing service levels (hospitals and long-term care homes), updated spending forecasts (physician payments, student enrolment and electricity price mitigation programs), and missed 2020-21 savings targets introduced at the time of the 2019 budget.

- $1.4 billion (16 per cent) is for program changes. This includes $596 million due to the deferral or reversal of program cuts included in the 2019 budget (public health, municipal ambulance services, secondary school class sizes, child care funding for municipalities, Ontario Works and Ontario Disability Support Program earnings exemptions) and $279 million to enhance the Autism program.

- The remaining $4.1 billion (47 per cent) is spending for identified measures in response to the COVID-19 outbreak and unallocated funds that have been earmarked by the Province as available to support the COVID-19 outbreak response.

- Finally, the FAO reviewed the Province’s $17 billion Action Plan against the new spending and revenue measures included in the March 2020 Update and found only $13.5 billion in new support related to the COVID-19 outbreak. There are two main reasons for the $3.5 billion difference:

- The Action Plan includes new spending in the health sector and for electricity price mitigation programs that is not related to the COVID-19 outbreak response. This includes funding to maintain existing (pre-COVID-19 outbreak) service levels for hospitals and long-term care homes, for updated spending forecasts for physician payments and the Province’s electricity price mitigation programs, and for health sector program changes, including the deferral and reversal of program cuts included in the 2019 budget (public health, municipal ambulance services and pharmacy payments).

- The Action Plan includes three revenue measures to improve cash flow for people and businesses by deferring, between 90 days and six months, filing and remittance deadlines for provincially administered taxes, Workplace Safety and Insurance Board (WSIB) employer premiums, and Education Property Tax payments. Based on the latest information available on the provincial economy, the FAO projects that people and businesses will owe less total taxes and WSIB premiums than estimated at the time of the March 2020 Update, resulting in less Action Plan cash flow support.[2]

Introduction

This report provides information on the Government of Ontario’s (the Province’s) 2020-21 spending plan of $174.3 billion outlined in the March 2020 Economic and Fiscal Update (March 2020 Update). The report:

- identifies changes to the 2020-21 spending plan since the 2019 Ontario Budget;

- reviews the changes to the 2020-21 spending plan by spending sector;

- categorizes 2020-21 spending plan changes, including the amount of new spending allocated to respond to COVID-19; and

- compares spending and revenue measures allocated to respond to COVID-19 against Ontario’s Action Plan 2020: Responding to COVID-19, which identified $17 billion in new support in 2020-21.

Changes to the 2020-21 Spending Plan

In the March 2020 Update, the Province outlined a spending plan for 2020-21 of $174.3 billion. This spending plan is up $10.8 billion, or 6.6 per cent, from the 2019-20 spending plan in the 2019 Ontario Budget. The $10.8 billion increase consists of a $2.2 billion increase that was identified in the 2019 budget and an additional $8.7 billion increase that was announced in the March 2020 Update.[3]

Figure 1 Change to the 2020-21 Spending Plan from the 2019 Ontario Budget to the March 2020 Economic and Fiscal Update ($ billions)

Source: FAO analysis of the 2019 Ontario Budget and the March 2020 Update.

Accessible version

| ($ billions) | |

|---|---|

| 2019-20 Spending Plan in 2019 Budget | 163.4 |

| 2020-21 Spending Plan Increase in 2019 Budget | 2.2 |

| 2020-21 Spending Plan Increase in March 2020 Update | 8.7 |

| 2020-21 Spending Plan in March 2020 Update | 174.3 |

Changes to the 2020-21 Spending Plan by Sector

| Sector | 2019-20 Spending Plan |

2020-21 Spending Plan Change in 2019 Budget |

2020-21 Spending Plan Change in March 2020 Update |

2020-21 Spending Plan |

Total Change from 2019-20 Spending Plan |

|---|---|---|---|---|---|

| Health | 63,437 | 1,135 | 3,272 | 67,844 | 4,407 |

| Education | 31,521 | 40 | 332 | 31,893 | 372 |

| Postsecondary Education | 10,458 | 64 | 145 | 10,667 | 209 |

| Children’s and Social Services | 16,587 | -135 | 1,245 | 17,697 | 1,110 |

| Justice | 4,336 | -97 | 294 | 4,532 | 196 |

| Other Programs | 22,670 | -636 | 5,110 | 27,144 | 4,474 |

| Contingency Funds | 1,100 | 1,459 | -1,259 | 1,300 | 200 |

| Interest on Debt | 13,335 | 341 | -477 | 13,199 | -136 |

| Total | 163,444 | 2,171 | 8,661 | 174,276 | 10,832 |

At the time of the 2019 Ontario Budget, the spending plan for 2020-21 was projected to increase by a net $2.2 billion compared to the 2019-20 spending plan. The net increase of $2.2 billion consisted of increases of $1.1 billion for the health sector, $1.5 billion for contingency funds[4] and $0.3 billion for interest on debt. Spending was projected to decrease year-over-year for the children’s and social services sector ($0.1 billion), justice sector ($0.1 billion) and other programs sector ($0.6 billion). For the education and postsecondary education sectors, spending was projected to remain largely unchanged.

In the March 2020 Update, an additional $8.7 billion was added to the 2020-21 spending plan. The net increase of $8.7 billion made noteworthy changes to most sectors. The health sector received an additional $3.3 billion, just over one-third of the $8.7 billion spending plan increase. The education and postsecondary education sectors received relatively smaller increases at $0.3 billion and $0.1 billion, respectively. The children’s and social services ($1.2 billion), justice ($0.3 billion) and other programs ($5.1 billion) sectors all received significant funding increases to offset originally planned spending decreases. Contingency funds ($1.3 billion decrease) and interest on debt ($0.5 billion decrease) received spending plan reductions to partially offset the increases to the other sectors.

Categorizing Spending Changes Announced in the March 2020 Update

As noted above, the March 2020 Update added $8.7 billion in funding to the 2020-21 spending plan. The FAO reviewed the $8.7 billion spending increase and grouped the new funding into four categories: program changes, allocation adjustments, COVID-19 response funding for identified measures, and unallocated funds. Overall, $1.4 billion in new funding is the result of program changes since the 2019 Ontario Budget, $3.2 billion is the result of allocation adjustments to existing programs with no changes to program service levels, $2.2 billion is new funding for measures in response to the COVID-19 outbreak, and $1.9 billion in new funding is unallocated at the start of the 2020-21 fiscal year.

| Category | Description | Spending |

|---|---|---|

| Program changes | Spending changes that result from new or eliminated programs, and existing programs with modified parameters (e.g., changes to service levels or eligibility). Includes any reversals of 2019 Ontario Budget program cuts. | 1,382 |

| Program allocation adjustments | Spending changes to existing programs but with no change in service level or eligibility. Includes updated demand forecasts (e.g., new projections for population growth or enrolment levels), new savings targets (e.g., efficiency goals), the reversal of 2019 budget savings targets that were not achieved, and the transfer of programs between sectors. | 3,180 |

| Allocated COVID-19 response funding | Spending for identified measures in response to the COVID-19 outbreak. Does not include funds that may be earmarked by the Province as available to support the COVID-19 outbreak response but, as of the release of the March 2020 Update, had not yet been allocated to a specific program or measure. | 2,177 |

| Unallocated funds | New requested spending authority that has not yet been allocated to a specific program or measure. Includes funds that may be identified by the Province as available to support the COVID-19 outbreak response but, as of the release of the March 2020 Update, had not yet been allocated to a specific program or measure. | 1,922 |

| Total spending changes | 8,661 |

In Table 3 below, the $8.7 billion in new funding is grouped into the four categories by sector.

| Sector | Program Changes | Program Allocation Adjustments | Allocated COVID-19 Response Funding | Unallocated Funds | 2020-21 Spending Plan Change in March 2020 Update |

|---|---|---|---|---|---|

| Health | 327 | 858 | 1,070 | 1,017 | 3,272 |

| Education | 394 | -62 | 0 | 0 | 332 |

| Postsecondary Education | 56 | 89 | 0 | 0 | 145 |

| Children’s and Social Services | 440 | 785 | 20 | 0 | 1,245 |

| Justice | 103 | 191 | 0 | 0 | 294 |

| Other Programs | 62 | 2,917 | 1,087 | 1,043 | 5,110 |

| Contingency Funds | 0 | -1,122 | 0 | -138 | -1,259 |

| Interest on Debt | 0 | -477 | 0 | 0 | -477 |

| Total | 1,382 | 3,180 | 2,177 | 1,922 | 8,661 |

Health

In the March 2020 Update, the Province added $3.3 billion to the 2020-21 health sector spending plan compared to the 2020-21 spending plan at the time of the 2019 budget. This new spending includes $1.1 billion in allocated COVID-19 response funding, $1.0 billion in unallocated funding that the Province has indicated is available to respond to the COVID-19 outbreak, $0.3 billion for program changes and $0.9 billion for program allocation adjustments.

- $1,070 million in allocated COVID-19 response funding, including: [5]

- $341 million for an additional 1,500 acute care beds (including 500 critical care beds) and more assessment centres;

- $243 million to long-term care homes to support infection control, provide COVID-related supplies and increase screening;

- $120 million to increase home and community care capacity;

- $85 million in additional funding for public health agencies (in addition to the reversal of a previous funding cut described below);

- $75 million for additional personal protective equipment;

- $61 million for physician services in assessment centres and health human resources, including enhanced physician services in remote communities; and

- $59 million for virtual doctor consultations and Telehealth.

- $1,017 million in unallocated funds that is earmarked to respond to the COVID-19 outbreak.

- $327 million in program changes, including:

- Program cut deferrals and reversals: $198 million in new funding to defer and reverse planned 2020-21 program cuts for public health, municipal ambulance services and pharmacy payments.[6]

- Program enhancements: $96 million for immunization programs and the Canadian Blood Services program.

- New programs: $33 million for a new maintenance capital program for the repair of long-term care homes and a new education and training program for long-term care workers.

- $858 million in program allocation adjustments, including:

- Additional funding to maintain existing service levels:

- $594 million for hospitals.

- $70 million for long-term care homes.

- Revised spending forecast: $200 million for the Ontario Health Insurance Program (OHIP) as a result of an updated physician billing forecast.

Education

In the March 2020 Update, the Province increased planned 2020-21 education sector spending by $0.3 billion compared to the 2020-21 spending plan at the time of the 2019 budget. This includes $0.4 billion in higher spending due to program changes, offset by ($0.1) billion in lower spending from program allocation adjustments:

- $394 million in program changes, including:

- Program cut deferrals and reversals:

- Program enhancements: $121 million to the Priority and Partnerships Fund and student transportation.[9]

- ($62) million net reduction for spending allocation adjustments, including:

- Revised spending forecasts:

- $129 million in additional funding for higher projected student enrolment.

- $51 million in additional funding for higher projected student transportation costs.

- ($168) million less funding due to a lower spending forecast for the Ontario Teachers’ Pension Plan.

- Capital spending changes: $53 million higher projected spending for the amortization costs of completed school board capital projects.

- New ministry savings targets: ($127) million less funding from unidentified ministry savings targets.

- Revised spending forecasts:

Postsecondary Education

In the March 2020 Update, the Province increased 2020-21 planned postsecondary education sector spending by $0.1 billion compared to the 2020-21 spending plan at the time of the 2019 budget. Of this increase, $56 million is for program changes, mostly for graduate education program funding increases. The remaining $89 million is for program allocation adjustments, which includes higher spending due to updated inter-ministry program transfers, offset by a lower spending forecast for the Ontario Student Assistance Program (OSAP) and for colleges.[10]

Children’s and Social Services

In the March 2020 Update, the Province increased 2020-21 planned spending in the children’s and social services sector by $1.2 billion compared to the 2020-21 spending plan at the time of the 2019 budget. This includes $0.4 billion for program changes, $0.8 billion for program allocation adjustments and $20 million in spending for ministry operations during the COVID-19 pandemic.

- $440 million in program changes, including:

- Program enhancements:

- $279 million in additional funding for the Autism program.

- $36 million in combined new funding for other programs, including the anti-human trafficking strategy and the Special Services at Home program.

- Program cut reversals: $125 million for the reversal of proposed changes to Ontario Works and Ontario Disability Support Program (ODSP) earnings exemptions.[11]

- Program enhancements:

- $785 million in spending allocation adjustments, including:

- 2019 budget savings target reversal: $750 million spending increase to reverse 2020-21 savings targets across a variety of programs that were not achieved.

Justice

In the March 2020 Update, the Province increased 2020-21 planned justice sector spending by $0.3 billion compared to the 2020-21 spending plan at the time of the 2019 budget. Of this amount, $191 million is for spending allocation adjustments, mostly for increased compensation. In addition, $103 million is for program changes, including the hiring of additional Ontario Provincial Police (OPP) officers and correctional services staff, and funding for the Province’s anti-human trafficking strategy.

Other Programs

In the March 2020 Update, the Province increased planned 2020-21 other programs sector spending by $5.1 billion compared to the 2020-21 spending plan at the time of the 2019 budget. This new spending includes $1.1 billion in allocated COVID-19 response funding, $1.0 billion in unallocated funding that the Province has indicated is available to respond to the COVID-19 outbreak, $62 million for program changes and $2.9 billion for program allocation adjustments.

The following table identifies the COVID-19 response measures and unallocated funds.

| Measure | Planned Spending |

|---|---|

| Child support to parents, including a one-time payment per child up to 12 years of age and emergency child care availability for front-line workers responding to COVID-19 | 516 |

| Social services relief funding to municipalities and Indigenous agencies and communities, and expanding access to the Ontario Works emergency assistance program | 196 |

| Setting time-of-use electricity rates at the lowest rate for 45 days and expanding eligibility for the Low-income Energy Assistance Program (LEAP) | 129 |

| Funding to Employment Ontario for skills training programs for workers affected by the COVID‑19 outbreak | 100 |

| Doubling the Guaranteed Annual Income System (GAINS) maximum payment for low-income seniors for six months | 75 |

| Other measures, including meal delivery for seniors, supporting seniors in retirement homes, and support for Ministry of Government and Consumer Services operations | 71 |

| Total COVID-19 Allocated Response | 1,087 |

| Unallocated funds available to respond to the COVID-19 outbreak | 1,043 |

| Total Other Programs Sector Spending Earmarked for COVID-19 Response | 2,130 |

- $62 million in program changes, including:

- New programs:

- $25 million for the Regional Opportunities Investment Tax Credit.

- $21 million for municipalities and school boards to review programs and service delivery.

- Program extension: $16 million for the Ontario Wine Fund and the Small Cidery and Small Distillery Support Program.

- New programs:

- $2,917 million in program allocation adjustments, including:

- Revised spending forecasts:

- $1,468 million increase for electricity price mitigation programs.

- $82 million increase for employee and pensioner benefits, including the Ontario Public Service Employees’ Union Pension Plan, the Public Service Pension Plan and retired employees’ benefits.

- $67 million net increase for the Province’s tax expenditures that are reported as program spending.[12]

- $67 million for higher projected Metrolinx operating spending.

- $46 million increase for emergency firefighting.

- Accounting changes:

- $161 million to consolidate the Investment Management Corporation of Ontario into Ministry of Finance spending beginning in 2020-21.

- Capital spending changes:

- $1,184 million increase for municipal transit investments and the Investing in Canada Infrastructure Program (ICIP); includes moving delayed 2019-20 project spending to 2020-21.

- ($477) million decrease to account for expected delays in infrastructure project construction timelines.[13]

- Revised spending forecasts:

Contingency Funds

In the March 2020 Update, the Province reduced its 2020-21 operating and capital contingency funds held with Treasury Board Secretariat by ($1.3) billion compared to 2020-21 operating and capital contingency fund levels at the time of the 2019 budget.

- ($1,122) million is a program allocation adjustment reduction to offset increases in various program sectors, including spending under ICIP.

- ($138) million is a reduction in unallocated funds.

Interest on Debt

In the March 2020 Update, the 2020-21 interest on debt spending forecast was reduced by ($0.5) billion compared to the 2020-21 spending forecast at the time of the 2019 budget.

A Review of the Province’s COVID-19 Action Plan

In Ontario’s Action Plan 2020: Responding to COVID-19 (the Action Plan), the Province identified “$17 billion in new support in 2020-21.”[14] The $17 billion was separated into $7.0 billion in new direct support and $10.0 billion to improve cash flow for people and businesses. The FAO reviewed the Province’s new spending and revenue measures included in the March 2020 Update and projects that the Action Plan will provide only $13.5 billion in new support in 2020-21 in response to the COVID-19 outbreak. This includes $4.5 billion in new direct support and $9.0 billion to improve cash flow for people and businesses.

$4.5 Billion in New Direct Support

As discussed above, the FAO categorized the new spending announced in the March 2020 Update and found that in the health sector, $2.1 billion in new spending was either allocated to COVID-19 response measures or was unallocated but earmarked as COVID-19 response funding. In addition, the other programs sector included $2.1 billion in new funding related to the COVID-19 outbreak response ($1.1 billion allocated to measures and $1.0 billion unallocated but earmarked as COVID-19 response funding). Lastly, the Province announced a temporary doubling of the Employer Health Tax Exemption, which the FAO estimates will cost the Province $0.2 billion in lower tax revenue.

In total, the FAO identified $4.5 billion in new direct support in response to the COVID-19 outbreak, which is $2.6 billion lower than the $7.0 billion in new direct support announced in the Province’s Action Plan. The main reason for the $2.6 billion difference is the characterization of new spending in the health and other programs sectors. In the health sector, the Province included $1.2 billion in new 2020-21 funding in the Action Plan, which the FAO found was not related to the COVID-19 outbreak response. Instead the new health sector funding was to maintain existing (pre-COVID-19 outbreak) service levels for hospitals and long-term care homes, for an updated physician billing forecast for the Ontario Health Insurance Program, and for program changes, including the deferral and reversal of program cuts included in the 2019 Ontario Budget (e.g., public health and municipal ambulance services). In the other programs sector, the Province included in the Action Plan $1.5 billion in new spending that resulted from an updated forecast for existing electricity price mitigation programs.[15]

$9.0 Billion to Improve Cash Flow for People and Businesses

Finally, the FAO projects that the three measures announced in the Action Plan to improve cash flow for people and businesses will provide $9.0 billion in cash flow support. This includes $5.4 billion through a five-month deferral of filing and remittance deadlines for a number of provincially administered taxes;[16] $1.9 billion from a 90-day deferral of Education Property Tax payments, which municipalities are required to submit to school boards; and $1.7 billion through a six-month deferral of Workplace Safety and Insurance Board (WSIB) premiums, which employers are required to pay on insurable employee earnings.

The FAO’s combined estimate of $9.0 billion in cash flow support is lower than the $10.0 billion announced by the Province in the Action Plan, largely due to the different estimates of the economic impact of the COVID-19 outbreak contained in the government’s March 2020 Update and the FAO’s later Economic and Budget Outlook (EBO).[17] Based on the latest information available on the provincial economy, the FAO projects that tax revenues for 2020-21 will be significantly lower than the Province’s forecast in the March 2020 Update, resulting in less Action Plan cash flow support as people and businesses will owe less total taxes and WSIB premiums than estimated in the March 2020 Update.[18]

| FAO Identified Support in Response to COVID-19 Outbreak | Ontario’s $17 Billion Action Plan | |

|---|---|---|

| New Direct Support | ||

| Health Sector | ||

| Allocated COVID-19 Response Funding | 1,070 | 1,115 |

| Unallocated Funds Earmarked for COVID-19 Response | 1,017 | 1,000 |

| Program Changes (mainly deferrals and reversals of 2019 budget program cuts) | – | 327 |

| Program Allocation Adjustments (funding for hospitals, physicians and long-term care homes to maintain pre-COVID-19 service levels and update spending forecasts) | – | 858 |

| Children’s and Social Services Allocated COVID-19 Response Funding | 20 | – |

| Other Programs Sector | ||

| Allocated COVID-19 Response Funding | 1,087 | 926 |

| Unallocated Funds Earmarked for COVID-19 Response | 1,043 | 1,043 |

| Program Allocation Adjustment: electricity price mitigation programs spending forecast update | – | 1,468 |

| Program Changes: Regional Opportunities Investment Tax Credit | – | 25 |

| Revenue Measure: temporary doubling of the Employer Health Tax Exemption | 234 | 265 |

| Total New Direct Support | 4,471 | 7,027 |

| Support for People and Businesses to Improve Cash Flow | ||

| Five-Month Deferral of Deadlines for Provincially Administered Taxes | 5,409 | 6,140 |

| 90-Day Deferral of Education Property Tax Payments from Municipalities to School Boards | 1,850 | 1,850 |

| Six-Month Deferral of Workplace Safety and Insurance Board Employer Premiums | 1,743 | 1,920 |

| Total Cash Flow Support | 9,002 | 9,910 |

| Total New Support in 2020-21 | 13,473 | 16,937 |

| Difference | -3,464 |

Footnotes

[1] Ontario’s Action Plan 2020: Responding to COVID-19.

[2] Overall, the FAO projects that the Province will collect $86 billion in total tax revenue in 2020-21, which is 20 per cent lower than the Province’s forecast of $108 billion in the March 2020 Update. For more information, see FAO, “Economic and Budget Outlook: Assessing the Impact of the COVID-19 Pandemic,” Spring 2020.

[3] Of the $8.7 billion increase, $1.5 billion was identified in the 2019 Ontario Economic Outlook and Fiscal Review, released in November 2019.

[4] Contingency funds are unallocated spending accounts, authorized by the legislature through the Supply Bill. During the year, if a program requires more funding than the amount requested through the Expenditure Estimates, then Treasury Board, a Cabinet committee, is authorized to transfer money from the contingency fund to the program through a Treasury Board Order. See Financial Administration Act, s. 1.0.8.

[5] For more information, see FAO, “Ontario Health Sector: A Preliminary Review of the Impact of the COVID-19 Outbreak on Hospital Capacity,” 2020.

[6] In the 2019 Ontario Budget, the Province announced that it would adjust provincial-municipal cost-sharing of public health funding, streamline land ambulance dispatch centres, and change the framework for pharmacy payments. Since the 2019 budget, the Province announced various modifications to the proposed changes, including that (a) public health cost-sharing would be deferred and transitional funding would be provided, (b) streamlining land ambulance dispatch centres would be deferred, and (c) the framework for pharmacy payments would be revised. The Province originally proposed that municipalities would be responsible for funding 30 per cent (rather than 25 per cent) and the City of Toronto 40 per cent (rather than 25 per cent) of public health costs beginning April 1, 2019. However, a revised date of January 1, 2020 was then proposed, with additional funding to mitigate the changes in 2020. The Province also delayed a proposed amalgamation of public health units from 35 to 10 and the proposal to streamline 59 emergency health services operators and 22 dispatch centres for land ambulances into 10 regional providers. The timing of these delays is contingent upon the outcome of the Ministry of Health’s consultations on public health and emergency health services. Lastly, the Province originally proposed introducing a tiered framework for drug mark-up fees and focusing the MedsCheck program on patients transitioning between health care settings. However, these proposals have been replaced with a new proposal for a reconciliation adjustment that deducts a percentage from payments to pharmacies. For more information on the government’s 2019 budget plan, see FAO, “Expenditure Estimates 2019-20: Ministry of Health and Long-Term Care,” 2019.

[7] In March 2019, the Province announced that funded average class sizes for secondary students would increase from 22 to 28 students per teacher, while funded average class sizes for students in grades 4 to 8 would increase from 23.84 to 24.50 students per teacher. In addition, beginning in the 2020-21 school year, secondary students were to take a minimum of four e-learning courses (the equivalent of one e-learning course per year) out of the 30 courses required to graduate from secondary school. E-learning courses were to have an average class size of 35 students per teacher. In March 2020, the Province announced that the average secondary school class size in 2020-21 would remain at 23 and e-learning would no longer be mandatory. See “Ontario Announces a Fair Plan to Keep Students in Class,” March 3, 2020. For more information on the government’s March 2019 plan, see FAO, “Expenditure Estimates 2019-20: Ministry of Education,” 2019.

[8] In the 2019 Ontario Budget, a number of changes to child care were reflected, including (a) a requirement that municipalities fund an additional 20 per cent of the operating costs for new child care spaces, (b) municipalities fund an additional percentage of administration costs, and (c) a reduction in the amount that municipalities could spend on administration costs from 10 per cent to 5 per cent. Since the 2019 Ontario Budget, the Province has announced that the proposed changes to operating cost funding of new child care spaces would be deferred until January 1, 2020 and transitional funding would be provided to municipalities to mitigate the changes for 2020. The Province also announced that the proposed changes to administration cost-sharing would be deferred until January 1, 2021 and the proposed changes to allowable administration costs would be deferred until January 1, 2022. For more information, see FAO, “Expenditure Estimates 2019-20: Ministry of Education,” 2019.

[9] The Priorities and Partnership Fund (PPF) supports initiatives such as parental outreach and engagement, mental health workers in schools, and math programs. In August 2019, the Province announced that school bus drivers could receive two retention bonuses of up to $1,000 each, based on continual employment from September 2019 to June 2020, with total provincial funding of about $40 million for 2019-20.

[10] The colleges spending forecast is down due to lower anticipated international student fees prior to the COVID-19 outbreak.

[11] In November 2018, the Province announced proposals to increase the amount of earnings that are exempt from benefit reductions under the Ontario Works program from $200 to $300 per month, replace the $200 monthly earnings exemption for Ontario Disability Support Program (ODSP) recipients with a $6,000 annual exemption, and increase the percentage of benefit reduction from 50 per cent to 75 per cent for earnings above these increased threshold amounts. In the 2019 Ontario Economic Outlook and Fiscal Review, the Province announced that it was no longer proceeding with the proposed changes to earnings exemptions for the Ontario Works program and the Ontario Disability Support Program.

[12] For more information on the Province’s tax expenditures, see FAO, “Tax Expenditures: Oversight, Growth and Distribution,” 2020.

[13] For more information on the government’s forecast policy for infrastructure spending, see 2019 Ontario Budget, p. 14. See also, FAO, “Expenditure Estimates 2019-20: Ministry of Transportation,” 2019, p. 13.

[14] Ontario’s Action Plan 2020: Responding to COVID-19, p. 3.

[15] The updated spending forecast for the Province’s electricity price mitigation programs was first identified in the 2019-20 Supplementary Estimates which was tabled on December 11, 2019.

[16] The provincial taxes that are subject to the deferral are the Employer Health Tax, Tobacco Tax, Fuel Tax, Gas Tax, Beer, Wine and Spirits Taxes, Mining Tax, Insurance Premium Tax, International Fuel Tax Agreement, Retail Sales Tax on Insurance Contracts and Benefit Plans, and Race Tracks Tax. The $5.4 billion cash flow support estimate includes $22 million in interest and penalties waived during the grace period.

[17] FAO, “Economic and Budget Outlook: Assessing the Impact of the COVID-19 Pandemic,” Spring 2020. There is also a $0.1 billion difference between the announced $10.0 billion in cash flow support and the Province’s internal projected cost for the three measures, which totals $9.9 billion, rather than $10.0 billion. See Table 5.

[18] The FAO projects that the Province will collect $86 billion in total tax revenue in 2020-21, which is 20 per cent lower than the Province’s forecast of $108 billion in the March 2020 Update. For more information, see FAO, “Economic and Budget Outlook: Assessing the Impact of the COVID-19 Pandemic,” Spring 2020.