Highlights

Program Overview

- In the 2020 Ontario Budget, the Province announced a plan to reduce electricity costs for industrial and large commercial ratepayers by subsidizing the cost of ‘green energy contracts’[1] (referred to in this report as the ‘renewable generation subsidy program’ or the ‘program’).

- The renewable generation subsidy program will shift approximately 85 per cent of the cost of electricity generated under the green energy contracts from ratepayers to the Province, until the last contract expires around 2040.

- The renewable generation subsidy will reduce the price of electricity for all ratepayers in Ontario. However, the Province will offset the benefit provided to residential, farm and small business ratepayers by lowering the discount provided through the Ontario Electricity Rebate (OER). As such, only large commercial and industrial ratepayers that are not eligible for the OER will receive a net reduction in their electricity costs.

Cost to the Province

- The FAO estimates that the renewable generation subsidy program will cost the Province a net $2.8 billion over the first three years of the program, from 2020-21 to 2022-23.

- The FAO’s three-year cost estimate is significantly higher than the Province’s cost estimate of $1.3 billion reported in the 2020 Ontario Budget. The Ministry of Energy, Northern Development and Mines confirmed to the FAO that the government’s estimate included additional cost forecast changes for the OER that were unrelated to the renewable generation subsidy program.

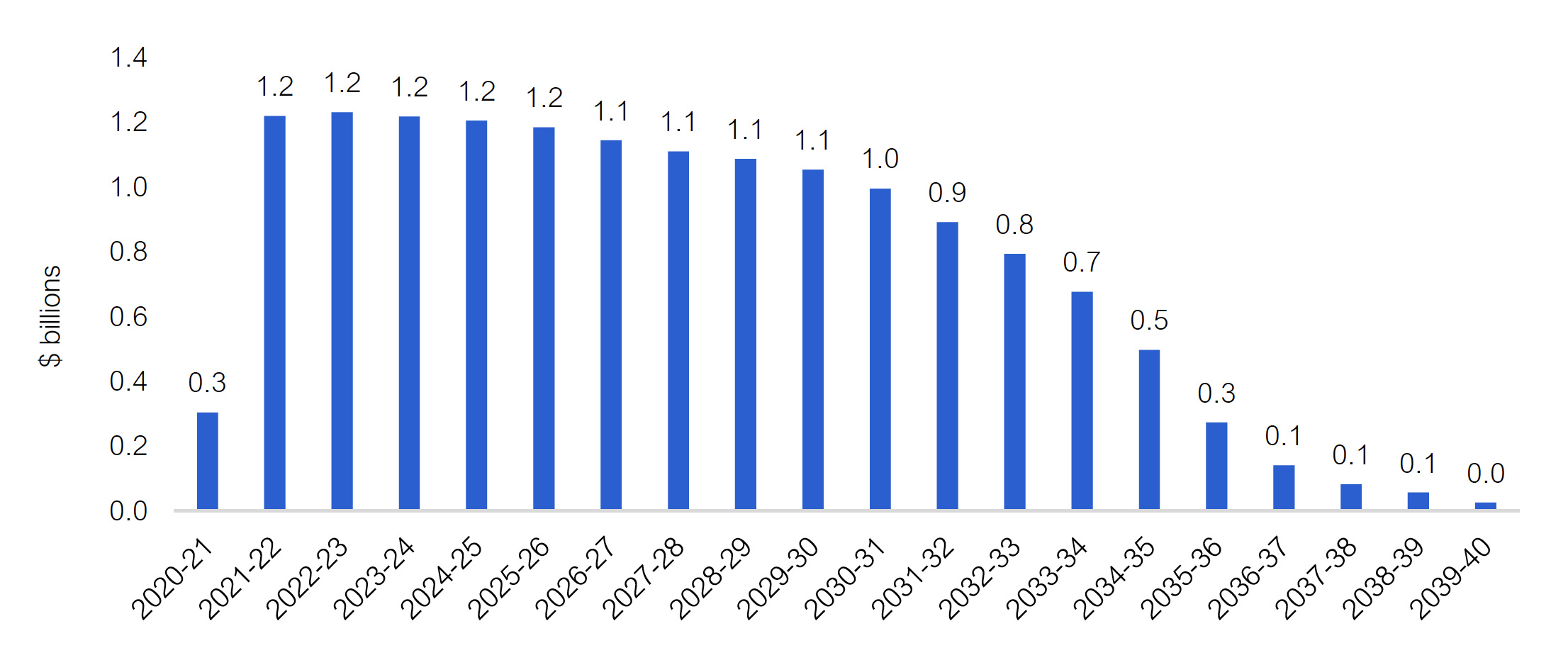

- Over the life of the program, from 2020-21 to 2039-40, the FAO estimates that the renewable generation subsidy program will cost the Province a net total of $15.2 billion.[2]

- The annual net cost of the program will decline over time due to a combination of the expiry of green energy contracts, largely beginning in 2028, and projected increases in the market price of electricity.

Impact on Industrial and Large Commercial Ratepayers

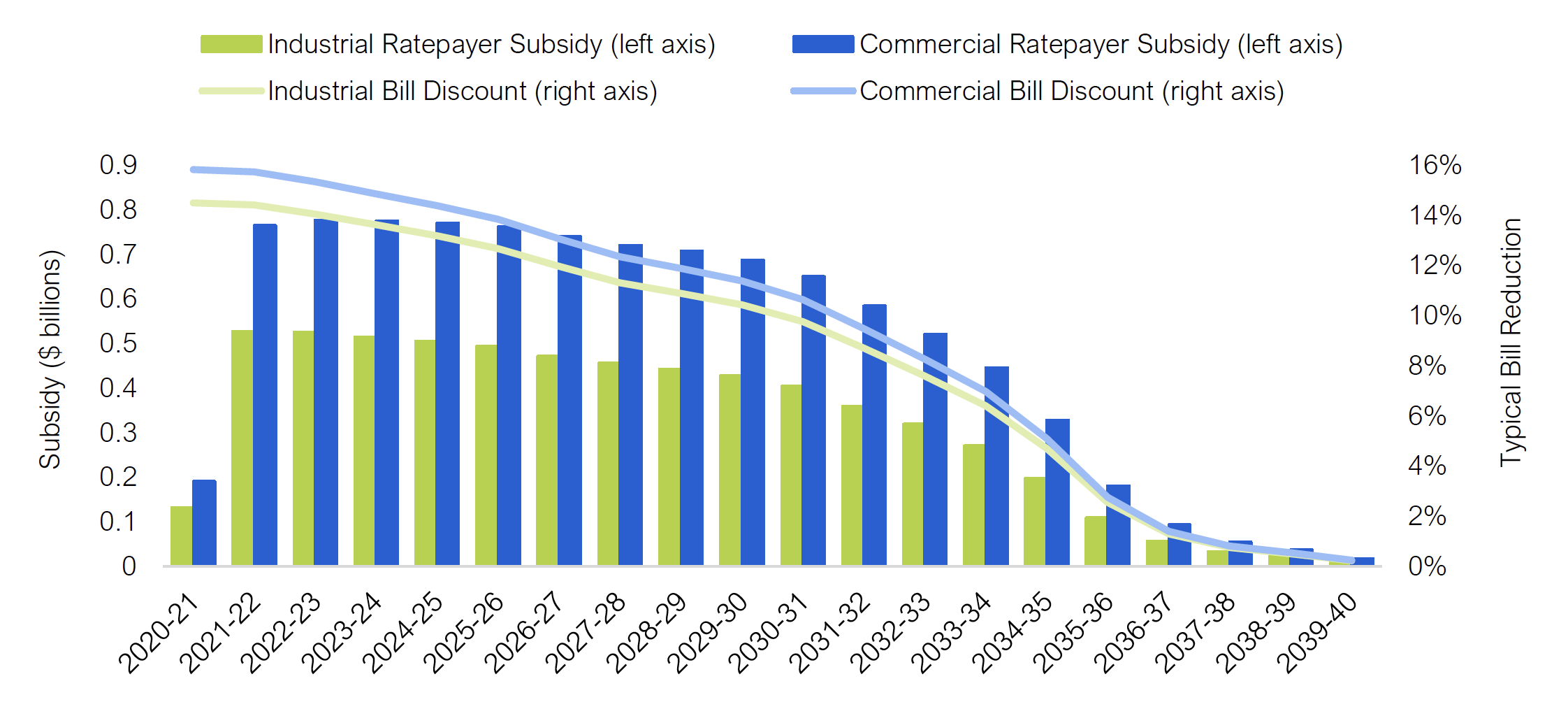

- In total, the FAO estimates that industrial and large commercial ratepayers will receive a $16.1 billion reduction in the cost of electricity from 2020-21 to 2039-40. Approximately 1,400 industrial ratepayers (such as auto parts manufacturers and pulp and paper mills) will receive a $6.3 billion subsidy through 2039-40, while large commercial ratepayers (such as hotels and office buildings) will receive a $9.8 billion subsidy.

- In 2021-22, industrial ratepayers will receive a $0.5 billion subsidy, which represents an average 17 per cent reduction in the price of electricity and a 14 per cent reduction in a typical industrial ratepayer’s electricity bill.[3]

- Large commercial ratepayers will receive a $0.8 billion subsidy in 2021-22, which represents an average 19 per cent reduction in the price of electricity and a 16 per cent reduction in a typical large commercial ratepayer’s electricity bill.[4]

- After accounting for the renewable generation subsidy in 2021-22, the FAO estimates that electricity prices for large commercial ratepayers will remain among the highest in Canada but will fall below the US average. For industrial ratepayers, the discount in 2021-22 will drop prices below the Canadian average and below prices in most competing US jurisdictions.[5]

- The annual subsidy provided to industrial and large commercial ratepayers will decline over time as the green energy contracts expire. The decline will be gradual from 2021-22 to 2029-30, with the annual subsidy decreasing by 14 per cent over that time. The decline will become more rapid starting in 2030-31 as large numbers of the subsidized green energy contracts begin to expire.

Introduction

Ontario has over 33,000 ‘green energy contracts’ with wind, solar and bioenergy generators, which secure approximately 12 per cent of Ontario’s electricity supply. Most of the green energy contracts have 20-year terms and were entered into between the introduction of the Green Energy Act, 2009 in 2009 and its repeal in 2019.[6] The prices paid to generators under the green energy contracts are significantly higher than the average price of electricity in Ontario.[7] These high contracted prices are one of the factors that contributed to the price of electricity in Ontario doubling from 2009 to 2019.[8]

In response to rising electricity prices, the Government of Ontario (the Province) implemented subsidy programs for residential, farm and small business ratepayers that significantly mitigated the impact of rising prices on their electricity bills.[9] In contrast, for large commercial and industrial ratepayers in Ontario, the price of electricity remained elevated compared to other North American jurisdictions. In 2020, electricity prices for large commercial ratepayers in Ontario were the highest in Canada and above the US average.[10] For industrial ratepayers, electricity prices in 2020 were higher than the Canadian average and higher than many competing US jurisdictions.[11] This led the Province, in the 2020 Ontario Budget, to announce a plan to reduce electricity costs for commercial and industrial ratepayers by subsidizing the cost of green energy contracts (referred to in this report as the ‘renewable generation subsidy program’ or the ‘program’).

The purpose of this report is to:

- explain how the renewable generation subsidy program will work;

- project the cost of the program to the Province; and

- estimate the impact of the program on Ontario electricity ratepayers.

How will the Renewable Generation Subsidy Work?

Starting January 1, 2021, the renewable generation subsidy program shifted approximately 85 per cent of the cost of electricity generated under the green energy contracts from ratepayers to the Province. This is equal to the proportion of the contract prices recovered through the global adjustment charge.[12] The renewable generation subsidy will continue for the life of the green energy contracts, until the last contract expires around 2040.

The renewable generation subsidy will reduce the price of electricity for all ratepayers in Ontario. However, the Province will offset the benefit provided to residential, farm and small business ratepayers by lowering the discount provided through the Ontario Electricity Rebate (OER).[13] As such, only large commercial and industrial ratepayers that are not eligible for the OER will receive a net reduction in their electricity costs.

Cost to the Province of the Renewable Generation Subsidy

The FAO estimates that the renewable generation subsidy will cost the Province $2.8 billion over the first three years of the program, from 2020-21 to 2022-23. Over the lifetime of the program to 2039-40, the total estimated cost to the Province is $15.2 billion.[14]

Medium-Term Cost, 2020-21 to 2022-23

Over the medium term, from 2020-21 to 2022-23, the FAO estimates that the renewable generation subsidy program will cost the Province a net $2.8 billion.

| 2020-21 | 2021-22 | 2022-23 | Total | |

|---|---|---|---|---|

| Cost of green energy contracts subsidized by the Province | 0.8 | 3.1 | 3.1 | 7.0 |

| Loss of provincial HST revenue | 0.0 | 0.1 | 0.1 | 0.2 |

| Savings from lowering the Ontario Electricity Rebate discount | -0.5 | -2.0 | -2.0 | -4.5 |

| Net cost to the Province | 0.3 | 1.2 | 1.2 | 2.8 |

From the start of the program on January 1, 2021 through 2022-23, the renewable generation subsidy will shift $7.0 billion of electricity generation costs from ratepayers to the Province. Additionally, the Province will lose approximately $0.2 billion of Harmonized Sales Tax (HST) revenue because pre-tax electricity bills will be lower by the amount of the renewable generation subsidy.[15] However, as noted above, in order to offset the cost of subsidizing the green energy contracts for residential, farm and small business ratepayers, the Province lowered the discount provided by the OER from 33.2 per cent to 21.2 per cent of the pre-tax electricity bill. This reduction in the OER discount will save the Province $4.5 billion over three years. Overall, this results in a net cost to the Province from the renewable generation subsidy program of $2.8 billion from 2020-21 to 2022-23.

The FAO’s net cost estimate of $2.8 billion from 2020-21 to 2022-23 for the renewable generation subsidy program is significantly higher than the Province’s cost estimate of $1.3 billion reported in the 2020 Ontario Budget.[16] The Ministry of Energy, Northern Development and Mines confirmed to the FAO that the government’s $1.3 billion net cost estimate included additional cost forecast changes for the OER that were unrelated to the renewable generation subsidy program.

Long-Term Cost, 2020-21 to 2039-40

Over the life of the program, from 2020-21 to 2039-40, the FAO estimates that the renewable generation subsidy will cost the Province a net $15.2 billion.[17]

| $ billions | |

|---|---|

| Cost of green energy contracts subsidized by the Province | 38.6 |

| Loss of provincial HST revenue | 1.3 |

| Savings from lowering the Ontario Electricity Rebate discount | -24.7 |

| Net cost to the Province | 15.2 |

From 2020-21 to 2039-40, the renewable generation subsidy will shift a total of $38.6 billion of electricity costs from ratepayers to the Province. The Province will also lose approximately $1.3 billion in HST revenue as pre-tax electricity bills will be lower by the amount of the renewable generation subsidy. However, the Province will recover $24.7 billion by reducing the OER discount provided to residential, farm and small business ratepayers. This results in a net cost to the Province from the program of $15.2 billion from 2020-21 to 2039-40.[18]

The annual net cost of the renewable generation subsidy program will decline over time due to a combination of the expiry of green energy contracts, largely beginning in 2028, and projected increases in the market price of electricity.[19]

Net annual cost to the Province from the renewable generation subsidy, 2020-21 to 2039-40, $ billions

Note: 2020-21 fiscal year net cost reflects the January 1, 2021 start date of the renewal generation subsidy program.

Source: FAO.

Accessible version

| Year | Net Annual Cost to the Province |

|---|---|

| 2020-21 | 0.3 |

| 2021-22 | 1.2 |

| 2022-23 | 1.2 |

| 2023-24 | 1.2 |

| 2024-25 | 1.2 |

| 2025-26 | 1.2 |

| 2026-27 | 1.1 |

| 2027-28 | 1.1 |

| 2028-29 | 1.1 |

| 2029-30 | 1.1 |

| 2030-31 | 1.0 |

| 2031-32 | 0.9 |

| 2032-33 | 0.8 |

| 2033-34 | 0.7 |

| 2034-35 | 0.5 |

| 2035-36 | 0.3 |

| 2036-37 | 0.1 |

| 2037-38 | 0.1 |

| 2038-39 | 0.1 |

| 2039-40 | 0.0 |

Impact on Electricity Ratepayers

In 2021-22, the first full year of the program, the renewable generation subsidy program will shift approximately $3.1 billion of electricity generation costs from Ontario electricity ratepayers to the Province. This will lower the on-bill price of electricity generation paid by all ratepayers in Ontario by approximately 20 per cent on average.[20] The FAO estimates that $1.3 billion of the subsidy will reduce costs for large commercial and industrial ratepayers. These ratepayers will see an equivalent net reduction in their electricity costs. The remaining $1.8 billion will reduce costs for residential, farm and small business ratepayers. However, due to the lowering of the OER rebate, on average, these ratepayers will not receive a net reduction in their electricity bills.

Impact on Industrial and Large Commercial Ratepayers

Impact in 2021-22

In 2021-22, the renewable generation subsidy will provide industrial and large commercial ratepayers with a $1.3 billion subsidy. The FAO estimates that, of the $1.3 billion subsidy, $0.5 billion will go to industrial ratepayers and $0.8 billion will go to large commercial ratepayers. Industrial ratepayers are approximately 1,400 large users of electricity such as auto parts manufacturers and pulp and paper mills.[21] Large commercial ratepayers are customers with electricity demand too high to qualify for the OER, such as hotels and office buildings.[22]

The $0.5 billion subsidy that will be paid to industrial ratepayers in 2021-22 represents an average 17 per cent reduction in the price of electricity and a 14 per cent reduction in a typical industrial ratepayer’s electricity bill.[23] The $0.8 billion subsidy that will be paid to large commercial ratepayers represents an average 19 per cent reduction in the price of electricity and a 16 per cent reduction in a typical commercial ratepayer’s electricity bill.[24] The actual electricity price reduction and electricity bill discount will vary significantly by ratepayer depending on electricity consumption and the proportion of each ratepayer’s electricity bill that funds the global adjustment charge.[25]

| 2021-22 | Total Subsidy Amount ($ billions) |

Average Electricity Price Discount | Typical Bill Reduction |

|---|---|---|---|

| Industrial Ratepayers | 0.5 | 17% | 14% |

| Large Commercial Ratepayers | 0.8 | 19% | 16% |

Overall, the FAO’s estimates for the electricity bill discounts for industrial and large commercial ratepayers are consistent with the estimates presented in the 2020 Ontario Budget.[26] After accounting for the impact of the renewable generation subsidy program in 2021-22, the FAO estimates that electricity prices for large commercial ratepayers will remain among the highest in Canada but will fall below the US average. For industrial ratepayers, the discount in 2021-22 will drop prices below the Canadian average and below prices in most competing US jurisdictions.[27]

Long-Term Outlook

In total, the FAO estimates that industrial and large commercial ratepayers will receive a $16.1 billion reduction in the cost of electricity from 2020-21 to 2039-40. Industrial ratepayers will receive a $6.3 billion subsidy through 2039-40, while commercial ratepayers will receive a $9.8 billion subsidy.

Annual subsidy and electricity bill discount to commercial and industrial ratepayers from the renewable generation subsidy program, 2020-21 to 2039-40

Note: 2020-21 subsidies reflect the January 1, 2021 start date of the renewal generation subsidy program. Electricity bill discounts in 2020-21 only apply to the three-month period starting January 1, 2021.

Source: FAO.

Accessible version

| Year | Industrial Ratepayer Subsidy ($ billions) |

Commercial Ratepayer Subsidy ($ billions) |

Industrial Bill Discount (%) |

Commercial Bill Discount (%) |

|---|---|---|---|---|

| 2020-21 | 0.1 | 0.2 | 14% | 16% |

| 2021-22 | 0.5 | 0.8 | 14% | 16% |

| 2022-23 | 0.5 | 0.8 | 14% | 15% |

| 2023-24 | 0.5 | 0.8 | 14% | 15% |

| 2024-25 | 0.5 | 0.8 | 13% | 14% |

| 2025-26 | 0.5 | 0.8 | 13% | 14% |

| 2026-27 | 0.5 | 0.7 | 12% | 13% |

| 2027-28 | 0.5 | 0.7 | 11% | 12% |

| 2028-29 | 0.4 | 0.7 | 11% | 12% |

| 2029-30 | 0.4 | 0.7 | 10% | 11% |

| 2030-31 | 0.4 | 0.6 | 10% | 11% |

| 2031-32 | 0.4 | 0.6 | 9% | 9% |

| 2032-33 | 0.3 | 0.5 | 8% | 8% |

| 2033-34 | 0.3 | 0.4 | 6% | 7% |

| 2034-35 | 0.2 | 0.3 | 5% | 5% |

| 2035-36 | 0.1 | 0.2 | 3% | 3% |

| 2036-37 | 0.1 | 0.1 | 1% | 1% |

| 2037-38 | 0.0 | 0.1 | 1% | 1% |

| 2038-39 | 0.0 | 0.0 | 0% | 1% |

| 2039-40 | 0.0 | 0.0 | 0% | 0% |

The annual subsidies will decline over time as the green energy contracts expire. The decline will be gradual from 2021-22 to 2029-30, with the annual subsidy decreasing by 14 per cent over that time. The decline will become more rapid starting in 2030-31 as large numbers of the subsidized green energy contracts begin to expire in 2030.

The electricity bill discounts will also decline as the green energy contracts expire. However, the decline will be slightly more rapid than the annual subsidy amounts. This is due to projected increases in the cost of electricity for commercial and industrial ratepayers from a combination of higher demand and rising prices. The rise in demand will spread the subsidies over a larger amount of electricity consumption, thus reducing the average bill discounts for individual ratepayers.[28] The rise in electricity prices means that the cost reductions from the renewable generation subsidy will make up a lower percentage of the electricity bill.

Impact on Residential, Farm and Small Business Ratepayers

The renewable generation subsidy will subsidize $1.8 billion in electricity generation costs in 2021-22 for residential, farm and small business ratepayers. These ratepayers will see a reduction in the electricity portion of their electricity bills. However, the Province will recover the subsidy provided to residential, farm and small business ratepayers by lowering the discount provided by the OER. Prior to January 1, 2021, the OER provided eligible ratepayers with a subsidy equal to 33.2 per cent of their before-tax electricity bill. Beginning January 1, 2021, the OER rebate was lowered to 21.2 per cent.

The FAO estimates that the reduction in the OER discount rate will reduce the subsidy paid to eligible ratepayers by $2.0 billion. However, OER recipients will also pay $0.2 billion less in federal and provincial HST because their pre-tax bills will be reduced by the renewable generation subsidy. Overall, the FAO estimates that, on average, the after-tax bills of residential, farm and small business ratepayers will not change.

| $ billions | |

|---|---|

| Savings from green energy contracts subsidized by the Province | 1.8 |

| Savings from lower HST costs | 0.2 |

| Cost from lower Ontario Electricity Rebate discount | -2.0 |

| Net change to OER eligible ratepayers | 0 |

However, because the renewable generation subsidy only reduces the electricity portion of ratepayer bills, while the OER discount is calculated based on the total before-tax bill (including electricity, delivery and regulatory), some residential, farm and small business ratepayers will see minor changes in their electricity bill costs. Ratepayers with above-average electricity consumption will receive a net reduction in their electricity bills, while ratepayers with lower-than-average electricity consumption will experience a net increase in their electricity bills.[29]

Footnotes

[1] Ontario has over 33,000 ‘green energy contracts’ with wind, solar and bioenergy generators, which secure approximately 12 per cent of Ontario’s electricity supply. Most of the green energy contracts have 20-year terms and were entered into between the introduction of the Green Energy Act, 2009 in 2009 and its repeal in 2019.

[2] In constant 2021 dollars, the estimated lifetime net cost of the renewable generation subsidy program is $13.4 billion.

[3] The typical industrial ratepayer is based on demand of 2,340,000 kWh per month.

[4] The typical commercial ratepayer is based on demand of 400,000 kWh per month.

[5] Competing US jurisdictions are Michigan, Indiana, Ohio, Pennsylvania, Illinois, New York, New Jersey, Wisconsin and Minnesota. The FAO projects that prices for industrial ratepayers in Ontario will be lower than eight of the nine states.

[6] This includes generation contracts under the Renewable Energy Supply Program, the Renewable Energy Standard Offer Program, the Feed-In Tariff Program, the microFIT Program and the Large Renewable Procurement Program.

[7] For reference, in 2020, the average price paid for wind, solar and bioenergy generation in Ontario was 21.5 c/kWh, while the average price of all generation was 10.1 c/kWh.

[8] In 2009, the average price of electricity in Ontario was 6.22 c/kWh. In 2019, the average price was 12.6 c/kWh. Other factors that contributed to the increase in the price of electricity include reductions in electricity demand and increases in the prices of nuclear, hydroelectric and natural gas generation.

[9] See FAO, “Home Energy Spending in Ontario: 2019 Update,” 2020. In 2019-20, the Province spent $5.4 billion on electricity price subsidies for residential, farm and small business ratepayers.

[10] FAO analysis of the US Energy Information Administration average retail prices of electricity to ultimate customers and Hydro-Quebec, “Comparison of Electricity Prices in Major North American Cities,” 2020.

[11] FAO analysis of the US Energy Information Administration average retail prices of electricity to ultimate customers and information provided to the FAO by the Ministry of Energy, Northern Development and Mines. Excludes the impact of the Northern Industrial Electricity Rate Program. Competing US jurisdictions are Michigan, Indiana, Ohio, Pennsylvania, Illinois, New York, New Jersey, Wisconsin and Minnesota. Prices for industrial ratepayers in Ontario were higher than five of the nine states.

[12] The global adjustment is a charge incorporated into electricity bills that makes up the difference between the market price of electricity in Ontario and the contracted or regulated prices paid to generators. (For more information see https://www.ieso.ca/en/power-data/price-overview/global-adjustment.) The calculation of the proportion of the green energy contract costs recovered through the global adjustment charge excludes the capacity value associated with the contracts. The capacity value comprises about 6.5 per cent of the total cost of the contracts.

[13] The OER is a rebate calculated based on the pre-tax bill of eligible residential, farm and small business ratepayers. Prior to the renewable generation subsidy, the OER provided residential, farm and small business ratepayers with a 33.2 per cent rebate. On January 1, 2021, the Province lowered the rebate to 21.2 per cent.

[14] In constant 2021 dollars, the estimated lifetime net cost of the renewable generation subsidy program is $13.4 billion.

[15] The FAO’s estimate for HST revenue loss is for electricity consumed by residential ratepayers only, as businesses can recover HST costs through the Input Tax Credit.

[16] See page 90 of the 2020 Ontario Budget for the Province’s estimate.

[17] In constant 2021 dollars, the estimated net cost of the program is $13.4 billion.

[18] The FAO’s estimated net program cost is sensitive to several factors, primarily electricity demand and the market price of electricity. For example, a 10 per cent increase in the FAO’s projected market price of electricity would lower the program cost by 1.7 per cent, as the proportion of the green energy contract costs recovered through the global adjustment charge, and subsidized by the Province, would drop.

[19] Projected increases in the market price of electricity in Ontario will lower the proportion of contracted generation costs recovered through the global adjustment charge. This will lower the proportion of the green energy contract costs subsidized by the Province.

[20] For example, on January 1, 2021, the Ontario Energy Board reduced the commodity price of electricity for most residential, farm and small business ratepayers by 19.4 per cent from $133.58/MWh to $107.73/MWh. The 20 per cent reduction only refers to the electricity portion of customer bills and excludes delivery, regulatory and HST charges.

[21] Class A ratepayers as defined by O. Reg. 429/04, s. 6.

[22] A sub-set of class B ratepayers as defined by O. Reg. 429/04, s. 5.

[23] The typical industrial ratepayer is based on demand of 2,340,000 kWh per month.

[24] The typical commercial ratepayer is based on demand of 400,000 kWh per month.

[25] The renewable generation subsidy program reduces the global adjustment charge on industrial and large commercial ratepayer bills. Therefore, the percentage reduction in the electricity bill will depend on the proportion of the bill made up by the global adjustment. This means that ratepayers with higher-than-average electricity use that pay higher global adjustment charges will see a larger than average percentage discount on their bill.

[26] See page 97 of the 2020 Ontario Budget.

[27] Competing US jurisdictions are Michigan, Indiana, Ohio, Pennsylvania, Illinois, New York, New Jersey, Wisconsin and Minnesota. The FAO projects that prices for industrial ratepayers in Ontario will be lower than eight of the nine states. Jurisdictional comparisons are based on prices as of July 2020 and does not reflect changes in the Canadian and US dollar exchange rate since July 2020, which will impact the jurisdictional comparison.

[28] The FAO’s demand projection is based on the Province’s forecast in the 2017 Long-Term Energy Plan, adjusted for differences in actual demand and prices from 2017 to 2021 and projected forward. This projection does not factor in potential additional increases in demand in response to lower electricity prices from the renewable generation subsidy program.

[29] For example, a residential ratepayer that uses 900 kWh per month will see a $1 decrease in their monthly electricity bill, while a ratepayer that uses 500 kWh per month will see a $1 increase in their monthly bill.