Key Points

- The FAO compiled a comprehensive list of service fees charged by the Province’s ministries and agencies. In total, the FAO identified over 1,100 service fees. The list is available for download on the FAO’s website.

- In 2017-18, the five most commonly paid service fees were:

- Highway 407 East tolls (11.9 million transactions);

- Car validations (i.e. licence plate stickers) in southern Ontario (6.8 million transactions);

- Vehicle permits (3.3 million transactions);

- PRESTO farecard overdraft fee charges (2.3 million transactions); and

- Fishing and hunting licences and permits (2.2 million transactions).

- For 2018-19, the Province changed 116 service fee rates: 87 fee increases, three new fees and 26 fee eliminations. The complete list of service fee rate changes is available for download on the FAO’s website.

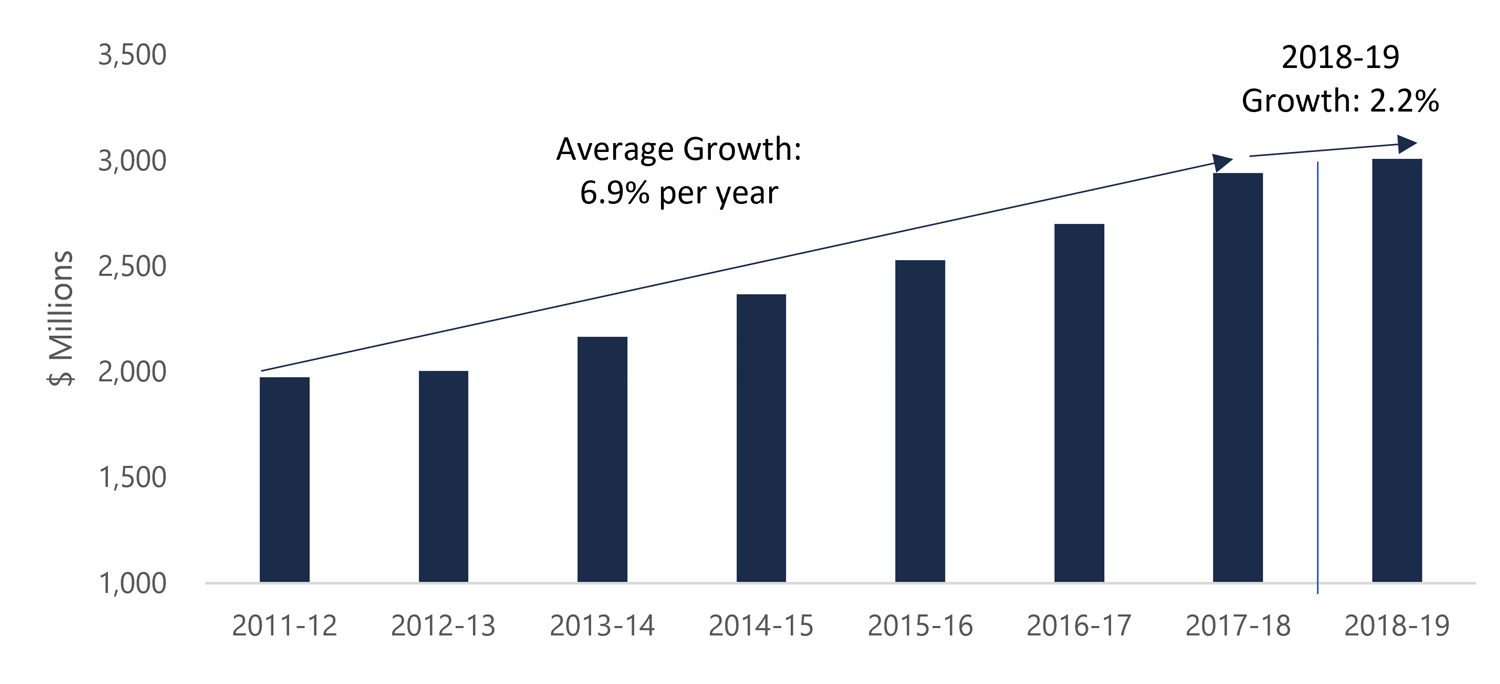

- The Province projects $3.0 billion in service fee revenue will be raised in 2018-19, an increase of 2.2 per cent from 2017-18.

- Between 2011-12 and 2017-18, service fee revenue increased at an average annual rate of 6.9 per cent, led by vehicle and driver registration fee revenue, which increased at an average annual rate of 10.1 per cent. In 2018-19, vehicle and driver registration fee revenue growth is projected to slow to 1.8 per cent.

- The Province charges service fees to recover part or all of the costs related to providing a service. This report examines how cost recovery rates have changed from 2017-18 to 2018-19 for a selection of service fee categories.

- Projected revenue in 2018-19 from personal property security fees, Ontario incorporation/business fees, and birth, marriage and death registration fees continues to significantly exceed program costs.

- Given the legal requirement that service fee rates have a reasonable connection to the cost of the service provided, it is possible that these service fees may be vulnerable to a legal challenge.

Background

The Province levies over 1,100 service, license and permit fees (hereafter all referred to as service fees).[1] In 2018-19, the Province expects to generate $3.0 billion in service fee revenue, up from $2.9 billion in 2017-18.[2]

The annual Ontario budget includes a forecast for service fee revenue for the upcoming fiscal year but does not publish information on planned service fee rate changes. This backgrounder provides:

- a list of service fee rate changes for 2018-19;

- a comprehensive list of all service fees charged by the Province’s ministries and agencies; and

- a follow-up to the FAO’s 2017-18 service fee backgrounder on cost recovery rates for a selection of the Province’s service fees.

Service Fee Rate Changes in 2018-19

Based on information provided to the FAO, the Province changed 116 service fee rates in 2018-19. These changes include 87 rate increases, three new fees and 26 fee eliminations. The complete list of service fee rate changes is available for download on the FAO’s website.

Service fee rate changes, 2018-19

|

Ministry/Agency |

Rate Increases |

Rate Decreases |

New Fees |

Eliminated Fees |

Total Fee Changes |

|---|---|---|---|---|---|

| Attorney General |

4 |

0 |

1 |

0 |

5 |

| Education |

1 |

0 |

0 |

0 |

1 |

| Energy, Northern Development and Mines |

11 |

0 |

2 |

22 |

35 |

| Environment, Conservation and Parks |

2 |

0 |

0 |

0 |

2 |

| Financial Services Commission of Ontario |

8 |

0 |

0 |

0 |

8 |

| Government and Consumer Services |

12 |

0 |

0 |

0 |

12 |

| Infrastructure |

2 |

0 |

0 |

0 |

2 |

| Municipal Affairs and Housing |

23 |

0 |

0 |

1 |

24 |

| Natural Resources and Forestry |

7 |

0 |

0 |

3 |

10 |

| Ontario Science Centre |

1 |

0 |

0 |

0 |

1 |

| Training, Colleges and Universities |

15 |

0 |

0 |

0 |

15 |

| Transportation |

1 |

0 |

0 |

0 |

1 |

| Total |

87 |

0 |

3 |

26 |

116 |

Note: Excludes previously scheduled fee rate increases for driver’s licensing and testing fees that were cancelled by the Province.

Source: Information provided by the Province.

While most rate increases reflect Consumer Price Index (CPI) adjustments, some fees were increased at rates significantly above inflation. The Ministry of the Attorney General increased special occasion liquor permits by between 40 per cent and 100 per cent. The Ministry of Energy, Northern Development and Mines eliminated 22 mining fees, introduced 2 new mining fees, and increased 11 other mining fees at rates between 48 per cent and 1,371 per cent. The Ministry of Transportation increased the driver’s licence reinstatement after suspension fee from $198 to $275 (a 39 per cent increase). The Financial Services Commission of Ontario increased mortgage broker application fees by between 45 per cent and 50 per cent. Finally, the Ministry of Natural Resources and Forestry eliminated three service fees in relation to fishing and hunting licences.

Services Fees in Ontario

For 2018-19, the FAO compiled a comprehensive list of service fees charged by the Province’s ministries and agencies. The list is available for download on the FAO’s website.

In total, the FAO identified over 1,100 service fees, representing approximately 99 per cent of the $2.9 billion in service fee revenue collected by the Province in 2017-18.[3]

Service fees by ministry and agency

|

Ministry/Agency |

Number of Fees |

|---|---|

| Agriculture, Food and Rural Affairs |

12 |

| Attorney General |

221 |

| Children, Community and Social Services |

9 |

| Community Safety and Correctional Services |

17 |

| Economic Development, Job Creation and Trade |

5 |

| Education |

5 |

| Energy, Northern Development and Mines |

40 |

| Environment, Conservation and Parks |

17 |

| Education Quality and Accountability Office |

6 |

| Finance |

8 |

| Financial Services Commission of Ontario |

93 |

| Freedom of Information Requests (all ministries) |

1 |

| Government and Consumer Services |

266 |

| Health and Long-Term Care |

13 |

| Indigenous Affairs |

0 |

| Infrastructure |

2 |

| Labour |

2 |

| Metrolinx |

3 |

| Municipal Affairs and Housing |

28 |

| Natural Resources and Forestry |

58 |

| Office of Francophone Affairs |

0 |

| Ontario Energy Board |

17 |

| Ontario Place Corporation |

4 |

| Ontario Science Centre |

8 |

| Ontario Securities Commission |

119 |

| Royal Ontario Museum |

5 |

| Seniors and Accessibility |

0 |

| Télévision française de l’Ontario |

1 |

| Tourism, Culture and Sport |

67 |

| TVOntario |

7 |

| Training, Colleges and Universities |

17 |

| Transportation |

74 |

| Treasury Board Secretariat |

0 |

Source: Information provided the Province.

Of the ten fees with the highest transaction volume (i.e., the most commonly paid fees), six were Ministry of Transportation fees, one was a Metrolinx fee, two were Ministry of Government and Consumer Services fees and one was a Ministry of Natural Resources and Forestry fee.

Top 10 service fees by number of transactions, 2017-18

|

Ministry/Agency |

Fee |

Rate ($) |

Transactions (millions) |

Revenue |

|---|---|---|---|---|

|

Transportation |

Highway 407 East Tolls |

3.92* |

11.9 |

46.7 |

|

Transportation |

Passenger Car Validation – Southern Ontario |

120.00 |

6.8 |

813.4 |

|

Transportation |

Permit Issue – Motor Vehicle/Dealer |

32.00 |

3.3 |

104.2 |

|

Metrolinx |

PRESTO Farecard Overdraft Fee |

0.25 |

2.3 |

0.6 |

|

Natural Resources and Forestry |

Fishing and Hunting Licences and Permits |

5.79 to 437.86 plus $2 service fee |

2.2 |

70.0 |

|

Transportation |

Driver’s Licence Original and Renewal |

90.00 (driver’s licence), 15.75 (knowledge test), 23.25 to 96.75 (road tests) |

1.3 |

145.7 |

|

Government and Consumer Services |

Search for a Lien |

8.00 |

1.3 |

10.3 |

|

Government and Consumer Services |

Register Financing Statements/Renewal |

8.00 to 200.00 |

1.3 |

51.1 |

|

Transportation |

Vehicle Number Plate (new and replacement) |

27.00 |

1.3 |

34.0 |

|

Transportation |

Driver Abstracts (history and search) |

12.00 plus $2 administration fee |

1.0 |

11.9 |

* Note: The rate for Highway 407 East tolls is a blended (or average) rate per trip.

Source: Information provided by the Province.

In 2017-18 the Ministry of Transportation collected Highway 407 East toll revenue from nearly 12 million trips. There were also 6.8 million transactions related to the annual passenger car validation fee charged to drivers in Southern Ontario. The Ministry of Transportation had several other highly utilized fees including: driver’s licences and renewals (1.3 million transactions), obtaining new or replacing vehicle number plates (1.3 million transactions), and driver’s licence history searches (1.0 million transactions). Metrolinx’s 25 cent fare overdraft fee for PRESTO cards was charged 2.3 million times.[4] Within the Ministry of Government and Consumer Services, searching for a lien and registering/renewing a lien under the Personal Property Security Act each had 1.3 million transactions. The Ministry of Natural Resources and Forestry processed over 2 million fishing and hunting licences and permits.

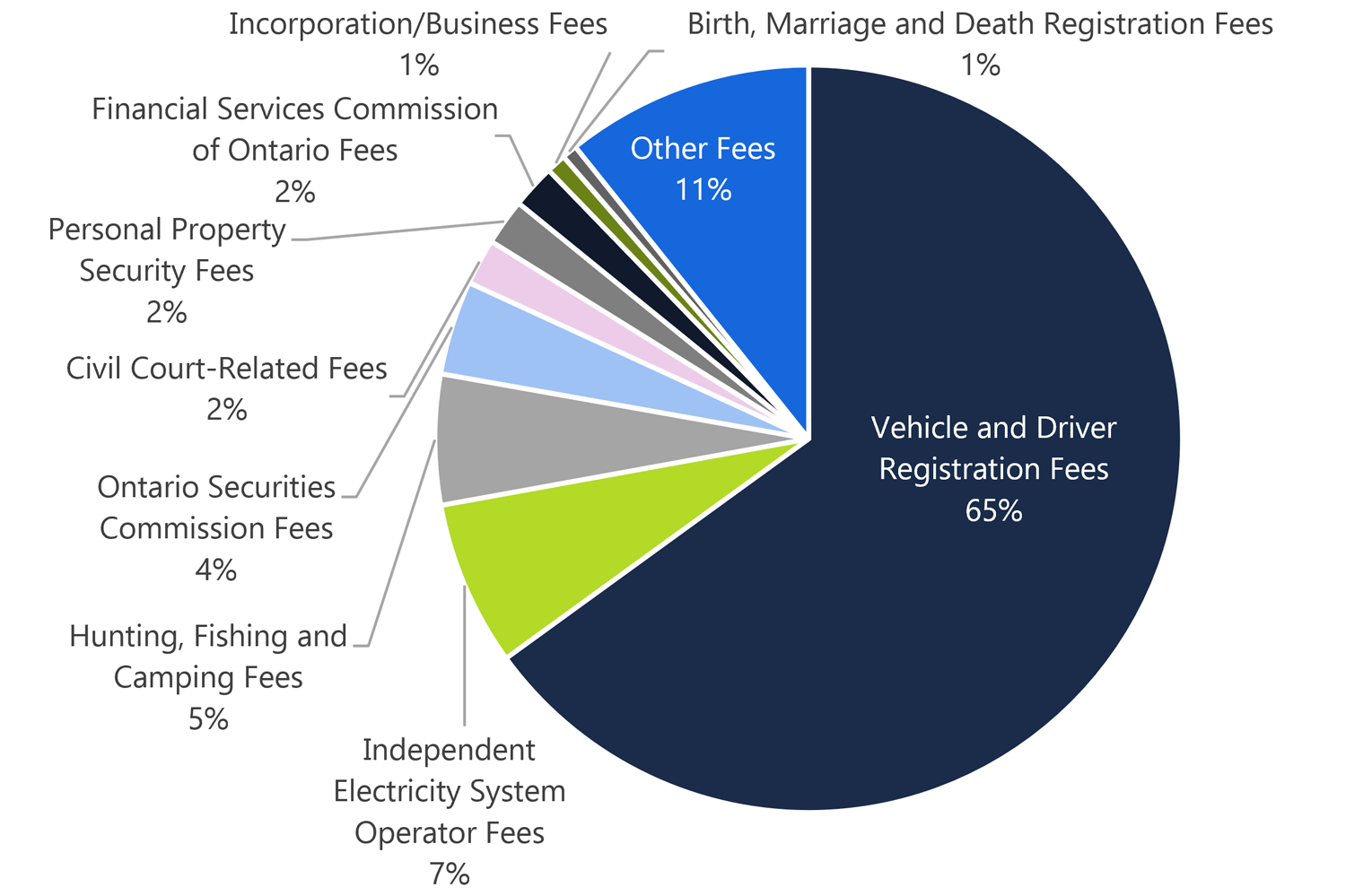

Main Sources of Service Fee Revenue

In 2017-18, the Province generated $2.9 billion in service fee revenue. Vehicle and driver registration fees, at $1.9 billion, made up 65 per cent of all fee revenue. The next largest fee categories were Independent Electricity System Operator fees (7 per cent), hunting, fishing, and camping fees (5 per cent), Ontario Securities Commission fees (4 per cent), court fees (3 per cent), personal property security fees (2 per cent), Financial Services Commission of Ontario fees (2 per cent), incorporation/business fees (1 per cent), and birth, marriage, and death registration fees (1 per cent). Combined, these fee categories represent 89 per cent of all service fee revenue.

Sources of service fee revenue, 2017-18

Source: 2017-18 Public Accounts of Ontario and Treasury Board Secretariat.

Growth in Service Fee Revenue

Service fee revenue increased by an average annual rate of 6.9 per cent between 2011-12 and 2017-18. This growth rate is projected to slow to 2.2 per cent for 2018-19.[5]

Service fee revenue growth, 2011-12 to 2018-19

Source: 2018 Ontario Economic Outlook and Fiscal Review and Public Accounts of Ontario.

The slowdown in the service fee revenue growth rate, from average annual growth of 6.9 per cent between 2011-12 and 2017-18 to 2.2 per cent in 2018-19 reflects slower growth in vehicle and driver registration fee revenue. Revenue for this fee category grew at an average annual rate of 10.1 per cent for the previous six years but is projected to grow by only 1.8 per cent in 2018-19. The slower growth rate in vehicle and drive registration fee revenue for 2018-19 is partly explained by the government’s decision to cancel previously planned fee rate increases.[6] However, the Province is also projecting a 0.3 per cent overall decline in transaction volume in 2018-19 compared to 2017-18. This is an unusual decline as transaction volume for vehicle and driver registration fees increased at an average annual rate of 2.6 per cent from 2013-14 to 2017-18.

Update on Service Fee Cost Recovery

The Province charges service fees to recover part or all of the costs related to providing a service. Last year’s FAO service fees backgrounder examined cost recovery ratios for five service fee categories: vehicle and driver registration fees; civil court-related fees; personal property security fees; Ontario incorporation/business fees; and birth, marriage and death registration fees.

The FAO has revisited the cost recovery ratios for these five fee categories in 2018-19.

Projected cost recovery ratios for five service fee categories, 2017-18 and 2018-19

|

Program Cost |

Fee Revenue |

Portion of |

||||

|---|---|---|---|---|---|---|

|

2017‑18 |

2018‑19 |

2017‑18 |

2018‑19 |

2017‑18 |

2018‑19 |

|

|

Vehicle and Driver Registration Fees |

2,220 |

2,383 |

1,912 |

1,947 |

86 |

82 |

|

Civil Court-related Fees |

212 |

N/A |

58.7 |

59.3 |

28 |

N/A |

|

Personal Property Security Fees |

4.6 |

4.7 |

59.0 |

60.1 |

1,283 |

1,279 |

|

Ontario Incorporation/Business Fees |

8.4 |

8.5 |

25.2 |

25.0 |

300 |

294 |

|

Birth, Marriage and Death Registration Fees |

15.9 |

16.2 |

19.4 |

19.7 |

122 |

122 |

Note: Program costs for personal property security fees; Ontario incorporation/business fees; and birth, marriage and death registration fees may be overstated. The Ministry of Government and Consumer Services (MGCS) reports that it continues to refine its costing methodology in response to recommendations from the Auditor General of Ontario in the 2009 Annual Report, “Government User Fees”, 2011 Annual Report, “Government User Fees Follow-up”, 2013 Annual Report, “ServiceOntario”, and 2015 Annual Report, “ServiceOntario Follow-up”.

Source: Information provided by the Province and the 2017-18 Public Accounts of Ontario.

For 2018-19, revenue from vehicle and driver registration fees is projected to recover 82 per cent of the program’s costs, down from 86 per cent in 2017-18.[7] This implies that the Province could increase vehicle and driver registration fees if the Province’s policy goal is to fully recover the program’s cost.

For civil court-related fees, the Ministry of the Attorney General was unable to provide a program cost estimate for 2018-19 as the ministry is currently updating its program costing methodology. In 2017-18, only 28 per cent of program costs were recovered through fee revenue.[8]

In contrast, revenue from personal property security fees; Ontario incorporation/business fees; and birth, marriage and death registration fees continues to significantly exceed program costs. For 2018-19, projected personal property security fee revenue is nearly 13 times larger than program costs; projected Ontario incorporation/business fee revenue is nearly 3 times program costs; and projected birth, marriage and death registration fee revenue is 1.2 times program costs, all largely unchanged from 2017-18.

The Province’s ability to set service fee rates is constrained by law. Revenue from service fees must maintain a reasonable connection to the cost of providing the service.[9] If there is no reasonable connection between the two, then the fee may be found by a court to be a “tax” not authorized by statute and, as a result, the fee could be declared unlawful. Therefore, a service fee that consistently collects revenue in excess of the cost of providing the service could be vulnerable to a legal challenge.[10]

Given that in 2018-19 the Province’s expected revenue from personal property security fees; Ontario incorporation/business fees; and birth, marriage and death registration fees is significantly higher than the cost of providing these services, some or all of these service fees may be vulnerable to a legal challenge. This concern was initially identified in the 2009 Annual Report by the Auditor General of Ontario.[11] Subsequent Auditor General reports in 2011, 2013 and 2015, and the FAO’s 2018 report have all identified this potential legal risk, as these fees have now collected revenue in excess of the cost of providing the service for a number of years.[12]

Michelle Gordon

Financial Analyst

mgordon@fao-on.org

Jeffrey Novak

Chief Financial Analyst

jnovak@fao-on.org

With contributions from Benjamin Premi-Reiller and Luan Ngo.

Financial Accountability Office of Ontario

2 Bloor Street West, Suite 900

Toronto, Ontario M4W 3E2

Media queries, contact: Kismet Baun, 416.254.9232 or email kbaun@fao-on.org.

About the FAO

Established by the Financial Accountability Officer Act, 2013, the Financial Accountability Office (FAO) provides independent analysis on the state of the Province’s finances, trends in the provincial economy and related matters important to the Legislative Assembly of Ontario. Visit our website at http://www.fao-on.org/en/ and follow us on Twitter at https://twitter.com/InfoFAO.

[1] The count of over 1,100 service fees is based on information provided by the Province.

[2] 2018 Ontario Economic Outlook and Fiscal Review, p. 125.

[3] Previous FAO backgrounders stated that there were over 400 service fees, based on the Auditor General of Ontario, 2009 Annual Report, “Government User Fees”, p. 143. The FAO’s new list of over 1,100 service fees reflects information provided to the FAO by each Ontario ministry.

[4] Metrolinx permits PRESTO users with insufficient funds on their card to take one trip. A $0.25 cent overdraft fee is charged when users reload their card.

[5] 2018 Ontario Economic Outlook and Fiscal Review, p. 125.

[6] Ontario Newsroom, “Ontario Freezing Driver Fees,” 21 August 2018 and Ontario Newsroom, “Ontario Freezing More Driver and Vehicle Fees,” 1 January 2019.

[7] Program costs connected to vehicle and driver registration fees include direct costs related to processing transactions and also costs associated with building and maintaining the Province’s highway infrastructure.

[8] There may be policy reasons (e.g. users’ ability to pay) why the Province may not fully recover the cost to provide a service. See Auditor General of Ontario, 2009 Annual Report, “Government User Fees”, p 147.

[9] See e.g. Nylene Canada Inc v Arnprior (Town), 2017 ONSC 795 at para 49, aff’d 2017 ONCA 726.

[10] The legal framework for service fees is based on several Supreme Court of Canada decisions: Eurig Estate (Re), [1998] 2 SCR 565; Ontario English Catholic Teachers’ Assn v Ontario (Attorney General), 2001 SCC 15; 620 Connaught Ltd v Canada (Attorney General), 2008 SCC 7; Confédération des syndicats nationaux v Canada (Attorney General), 2008 SCC 68. See also Auditor General of Ontario, 2011 Annual Report, “Government User Fees Follow-up”, p. 341.

[11] Auditor General of Ontario, 2009 Annual Report, “Government User Fees”, p. 145.

[12] Auditor General of Ontario, 2011 Annual Report, “Government User Fees Follow-up”, p. 343; Auditor General of Ontario, 2013 Annual Report, “ServiceOntario” pp. 257-258; Auditor General of Ontario, 2015 Annual Report, “ServiceOntario Follow-up”, p. 678; and Financial Accountability Office, Ontario Service Fees in 2017-18, pp. 4-5.

Growth in Service Fee Revenue

This chart shows actual Provincial revenue from service fees over the period of 2011-12 to 2017-18, with a growth rate of 6.9 per cent over this period. The chart also shows the Province’s forecasted revenue from service fees in 2018-19, which is expected to grow by 2.2 per cent versus the prior year. Overall, the chart shows continual increases to service fee revenue, at $2.0 billion, $2.9 billion and $3.0 billion for the years 2011-12, 2017-18 and 2018-19, respectively.

Sources of Service Fee Revenue, 2017-18

This chart shows the sources of the $2.9 billion in Provincial service fee revenue for 2017-18. Vehicle and driver registration fees is the largest category, which accounted for 65 per cent of the total revenue. The contributions of the remaining categories are as follows: Independent Electricity System Operator Fees at 7 per cent, Hunting, Fishing and Camping Fees at 5 per cent, Ontario Securities Commission Fees at 4 per cent, Financial Services Commission of Ontario Fees at 2 per cent, Civil Court-related Fees at 2 per cent, Personal Property Securities Fees at 2 per cent, Incorporation / Business Fees at 1 per cent, Birth Marriage and Death Registration Fees at 1 per cent, and finally, Other Fees at 11 per cent.