Key Messages

- This commentary compares the recently introduced Low-income Individuals and Families Tax (LIFT) credit to the cancelled minimum wage increase from $14 per hour to $15 per hour. The commentary estimates the change to the Province’s budget balance and reviews the impacts to individuals and families.

- As a result of introducing the LIFT credit and cancelling the increase in the minimum wage, the Province’s budget balance will worsen by a total of $1.9 billion over five years from 2018-19 to 2022-23. The cost of the LIFT credit is projected to peak at $413 million in 2019-20 and gradually decline thereafter, as the credit is not indexed to inflation.

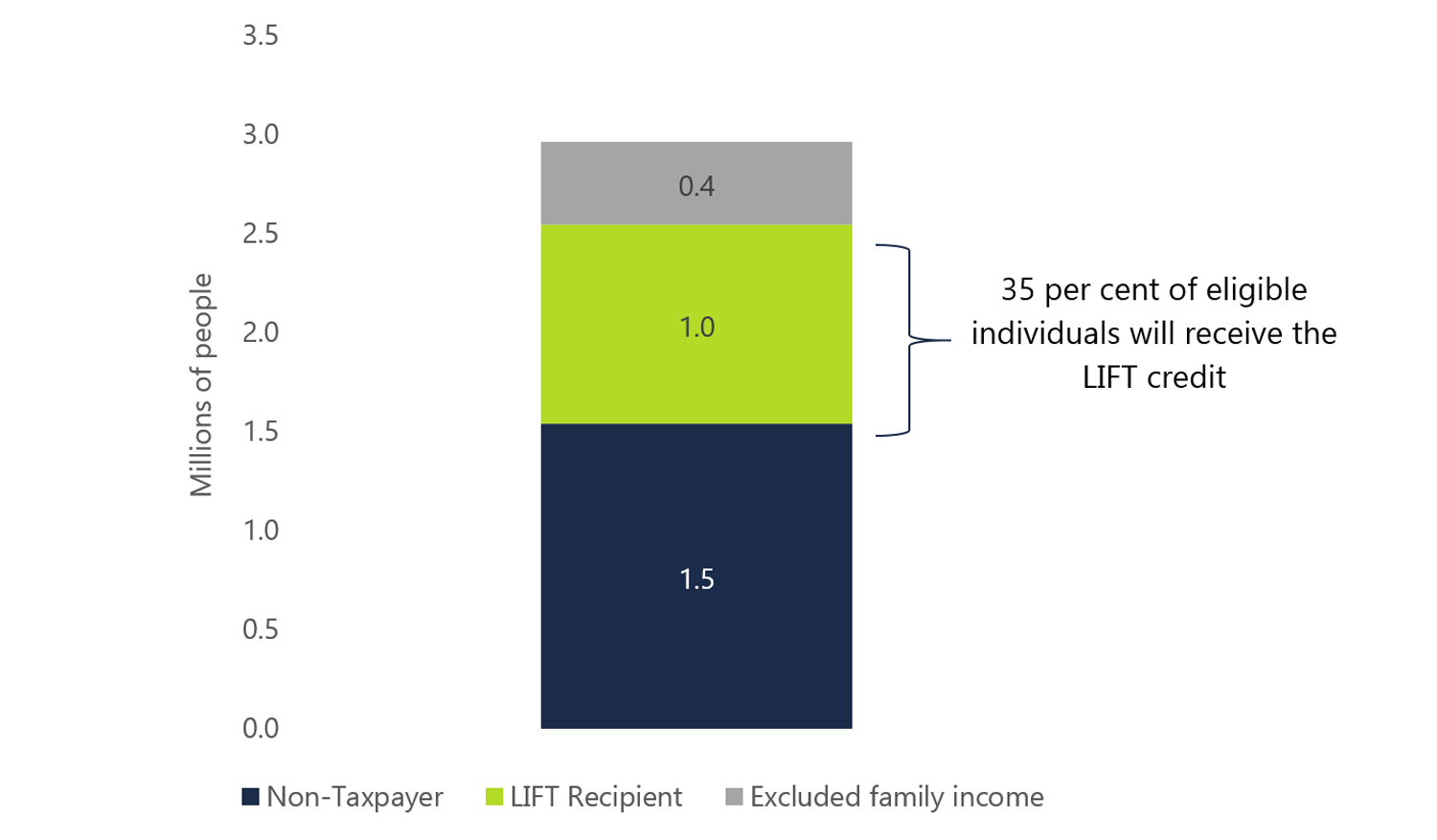

- There are 2.9 million employed individuals in Ontario with incomes less than $38,500 that are eligible for the LIFT credit. The FAO estimates that of these 2.9 million individuals, 1.0 million will receive the credit for a total net benefit of $0.4 billion.

- Recipients of the LIFT credit will receive an average benefit of $409 in 2019.

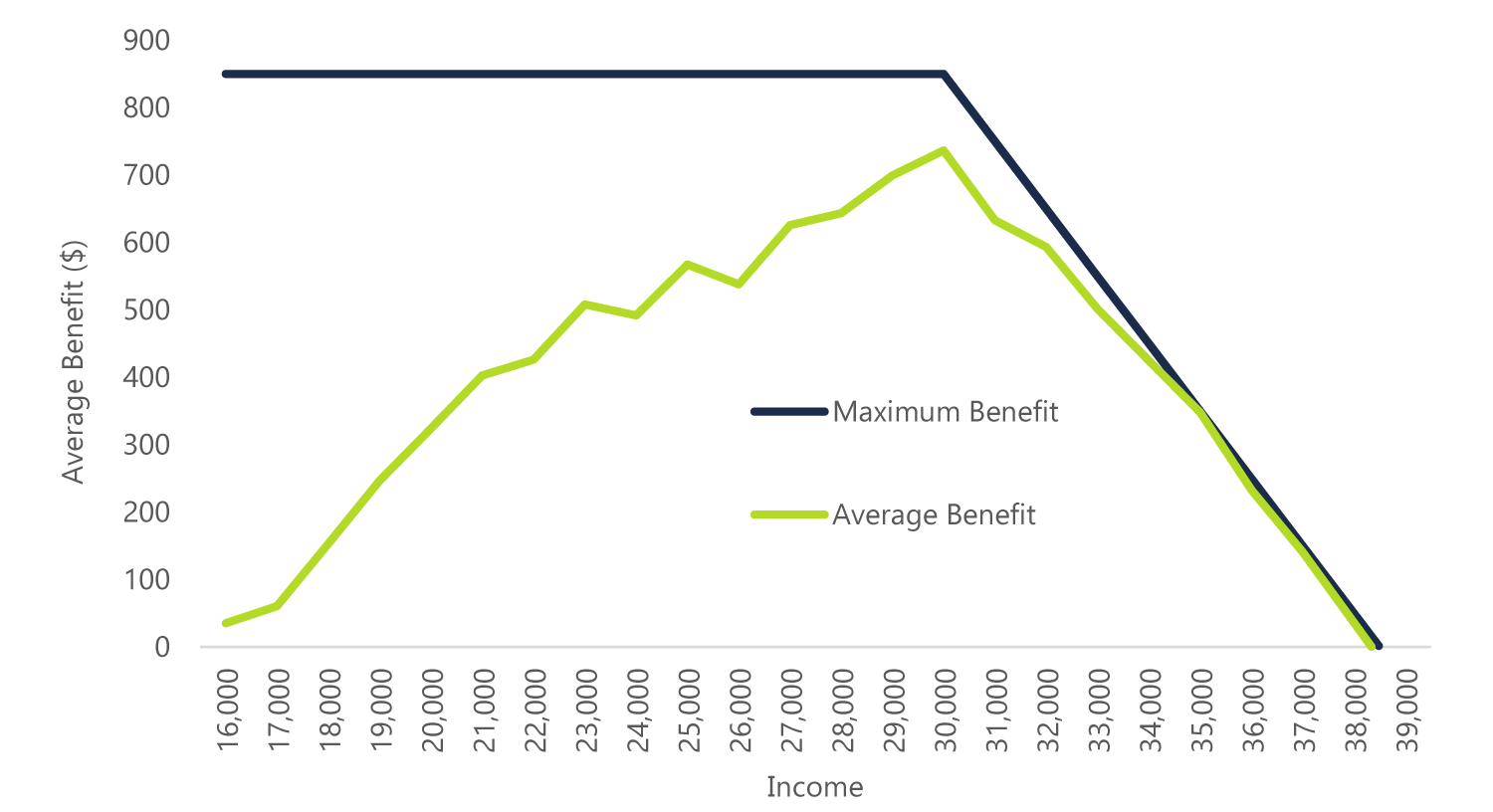

- Only an estimated 19,000 Ontarians will receive the maximum potential LIFT credit of $850 as very few eligible LIFT recipients pay enough Ontario personal income tax to qualify.

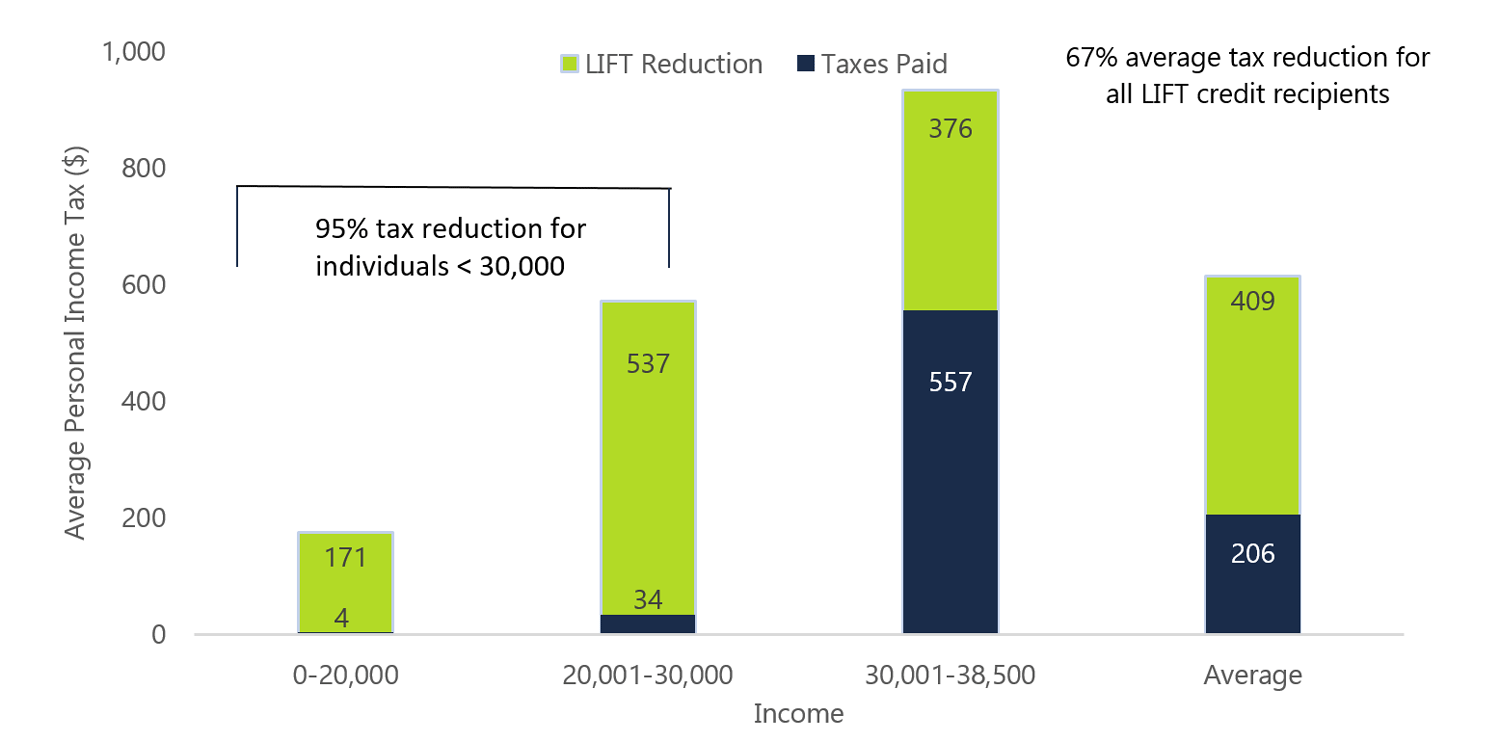

- The LIFT credit will eliminate Ontario personal income taxes (excluding the Ontario Health Premium) for 590,000 Ontarians with incomes below $30,000, increasing the proportion of Ontarians with incomes below $30,000 who do not pay Ontario personal income tax from 78 per cent to 90 per cent.

- The FAO estimates that 1.3 million individuals would have received a total net after-tax benefit of $1.1 billion from increasing the minimum wage to $15 per hour from $14 per hour. On average, workers receiving the minimum wage increase would have received a net after-tax benefit of $810.

- Approximately 38 per cent of minimum wage earners, or 503,000 individuals, will receive the LIFT credit.

- An increase in the minimum wage would have provided more aggregate benefits to individuals with below-median incomes compared to the LIFT credit. However, on a relative basis, the LIFT credit provides a greater portion of its overall lower benefits (97 per cent) to individuals with below-median incomes compared to the minimum wage increase (86 per cent).

- Finally, both policy options provide limited support to low-income families, with only about 10 per cent of their respective benefits going to individuals in low-income families.

Background

In the 2018 Ontario Economic and Fiscal Review (also known as the Fall Economic Statement or FES), the Government of Ontario (the Province) announced the Low-income Individuals and Families Tax (LIFT) credit. Effective January 1, 2019, the LIFT credit will provide annual rebates to eligible Ontarians so that low-income individuals and families will pay little or no Ontario personal income tax, including those earning minimum wage.[1]

Following the announcement of the LIFT credit, on November 21, 2018, the Legislative Assembly passed Bill 47, Making Ontario Open for Business Act, 2018. This bill included an amendment to the Employment Standards Act, 2000 which cancelled the planned January 1, 2019 increase in the minimum wage from $14 per hour to $15 per hour.[2] Going forward, the $14 per hour minimum wage will increase each year, starting October 1, 2020, by the rate of inflation.[3]

The purpose of this commentary is to compare the LIFT credit to the cancelled minimum wage increase from $14 per hour to $15 per hour. The commentary begins with an estimate of the impact to the Province’s budget balance from the new LIFT credit and the cancelled minimum wage increase. Next, the commentary reviews the impact of the LIFT credit on individuals and families. Finally, the commentary compares the LIFT credit to an increase in the minimum wage, including the total estimated benefit and the distribution of the benefit to individuals and families.

This commentary does not provide a review of the economic effects of replacing the minimum wage increase with the LIFT credit, as this analysis was outside the scope of this report. However, the final section of this report does offer some general considerations.

Impact of the LIFT Credit and Cancelling the Minimum Wage Increase on the Province’s Budget Balance

As a result of introducing the LIFT credit and cancelling the increase in the minimum wage from $14 per hour to $15 per hour, the FAO estimates that the Province’s budget balance will worsen by a total of $1.9 billion over five years from 2018-19 to 2022-23. For fiscal year 2018-19, the Province’s budget balance is expected to deteriorate by $122 million, followed by a drop of $472 million in 2019-20, $453 million in 2020-21, $434 million in 2021-22 and $416 million in 2022-23.

Estimated impact on the Province’s budget balance from introducing the LIFT credit and cancelling the minimum wage increase, $ millions

|

$ millions |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

Total |

|---|---|---|---|---|---|---|

|

LIFT credit |

(104) |

(413) |

(393) |

(373) |

(353) |

(1,636) |

|

Cancelling the minimum wage increase |

(18) |

(59) |

(60) |

(61) |

(63) |

(261) |

|

Impact to budget balance |

(122) |

(472) |

(453) |

(434) |

(416) |

(1,897) |

Source: FAO analysis of Statistics Canada’s Labour Force Survey (January-December 2018) and Social Policy Simulation Database and Model.

The deterioration in the budget balance consists of the cost of the LIFT credit combined with the loss of provincial income tax revenue that would have been generated from increasing the incomes of minimum wage workers.[4] For reference, in the 2018 Fall Economic Statement, the Province estimates that the LIFT credit will cost $495 million for the 2019 calendar year, which is more conservative than the FAO’s estimate of approximately $418 million.[5] However, both projections are sensitive to forecasting uncertainty.

Importantly, the maximum LIFT benefit and the income thresholds for LIFT eligibility are not indexed to inflation and will not increase in future tax years.[6] As a result, the cost of the LIFT credit is projected to decrease over time. Should the maximum LIFT benefit or income thresholds be adjusted through a future amendment to the Taxation Act, 2007, the FAO’s estimate of the impact to the budget balance would change.

The following sections look specifically at the 2019 calendar year to analyze how replacing the minimum wage increase with the LIFT credit will affect Ontarians.

Structure of the LIFT Credit

The LIFT credit entitles individuals that earn less than $30,000 to a tax credit equal to 5.05 per cent of their employment income up to a maximum of $850 ($1,700 per couple).[7] The maximum rebate of $850 is approximately equal to the amount of Ontario personal income tax an individual working full time at the Ontario minimum wage would pay in 2019.[8]

The LIFT credit cannot exceed provincial income taxes payable (less the Ontario Health Premium)[9] and is gradually reduced for individuals with adjusted net income[10] greater than $30,000 and families with adjusted net income greater than $60,000.[11] The benefit is completely phased out once individual adjusted net income reaches $38,500 or family adjusted net income reaches $68,500.

Effect of the LIFT Credit on Individuals and Families

There are 2.9 million employed individuals in Ontario with income less than $38,500 that are eligible for the LIFT credit, of which the FAO estimates that 1.0 million will receive the credit.[12] Of the 1.9 million eligible individuals that will not receive the LIFT credit, 1.5 million are excluded because those individuals already do not pay any Ontario personal income tax and the remaining 0.4 million are excluded due to having a higher earning spouse or common-law partner.

35 per cent of 2.9 million eligible individuals will receive the LIFT credit

Source: FAO analysis of Statistics Canada’s Social Policy Simulation Database and Model.

LIFT credit will provide recipients an average rebate of $409 in 2019

The FAO estimates that the 1.0 million recipients of the LIFT credit will receive an average benefit of $409 in 2019.[13],[14] The highest average benefits, at $541, will be paid to individuals with annual employment income between $20,001 and $30,000. Individuals earning between $28,000 and $29,500, which is approximately equal to the employment income of a full-time minimum wage earner, will earn an average LIFT credit of $705.

Average individual LIFT credit by employment income

Source: FAO analysis of Statistics Canada’s Social Policy Simulation Database and Model.

The average benefit of $409 is significantly lower than the maximum benefit of $850. The FAO estimates that of the 1.0 million LIFT credit recipients only 19,000 will receive the maximum benefit of $850. The primary reason so few individuals will be entitled to the maximum benefit of $850 is that very few eligible LIFT recipients pay enough Ontario personal income tax to qualify. In addition, recipients of the LIFT credit with incomes over $30,000 cannot receive the maximum benefit due to the reduction of the LIFT credit for individuals earning between $30,000 and $38,500.[15]

Maximum and average individual 2019 LIFT credit

Source: FAO analysis of Statistics Canada’s Social Policy Simulation Database and Model.

LIFT credit recipients’ provincial taxes will be reduced significantly

The FAO estimates that the LIFT credit will eliminate Ontario personal income taxes (excluding the Ontario Health Premium) for 590,000 Ontarians with incomes below $30,000, increasing the proportion of Ontarians with incomes below $30,000 who do not pay Ontario personal income tax from 78 per cent to 90 per cent. The FAO’s analysis is consistent with the Province’s announcement in the 2018 Fall Economic Statement that the LIFT credit, combined with existing tax relief, would result in most people earning less than $30,000 paying no Ontario personal income tax.[16]

Finally, the FAO estimates that the LIFT credit will reduce Ontario personal income taxes paid by individuals earning $38,500 or less by an average of 67 per cent. For individuals earning $30,000 or less, they will experience an average reduction of Ontario personal income tax owing of 95 per cent.

LIFT credit recipients’ provincial taxes will be reduced significantly

Source: FAO analysis of Statistics Canada’s Social Policy Simulation Database and Model.

Comparing the LIFT Credit to Raising the Minimum Wage

The LIFT credit was introduced to provide support to low-income workers, including those that would have benefited from an increase in the minimum wage.[17] This section compares the estimated benefits that individuals would have received from increasing the minimum wage to $15 per hour from $14 per hour, versus the estimated benefits from the LIFT credit.

LIFT provides less benefit than the cancelled minimum wage increase

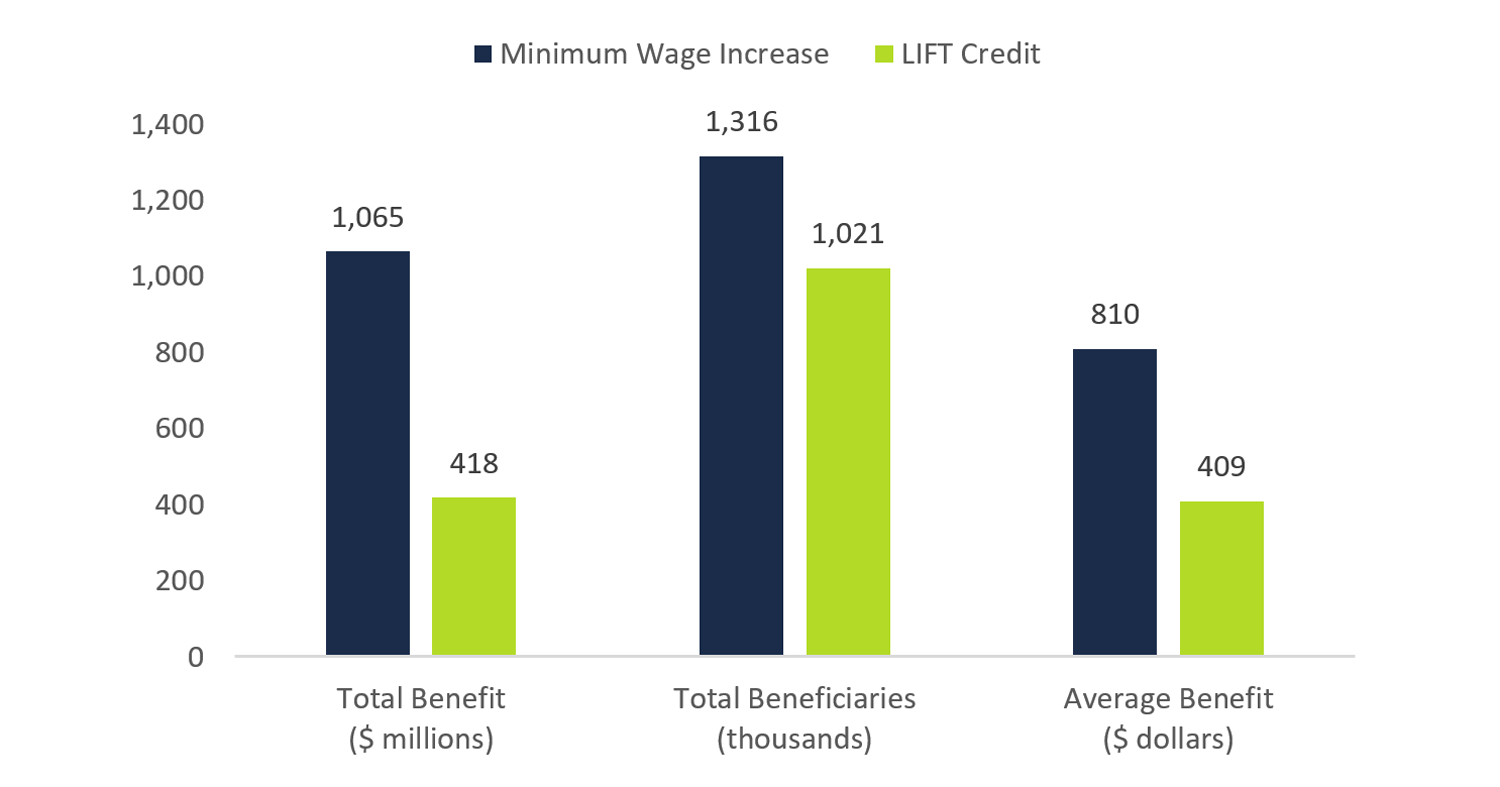

The FAO estimates that 1.3 million individuals would have received a total net after-tax benefit of $1.1 billion from increasing the minimum wage to $15 per hour from $14 per hour. On average, workers receiving the minimum wage increase would have received a net after-tax benefit of $810.[18] In comparison, the FAO estimates that 1.0 million individuals will receive a total net benefit of $0.4 billion from the LIFT credit, for an average individual benefit of $409.[19]

Comparison of benefits between minimum wage increase and LIFT credit

Note: Numbers may not add due to rounding.

Source: FAO analysis of Statistics Canada’s Labour Force Survey (January-December 2018) and Social Policy Simulation Database and Model.

Most minimum wage earners won’t benefit from LIFT

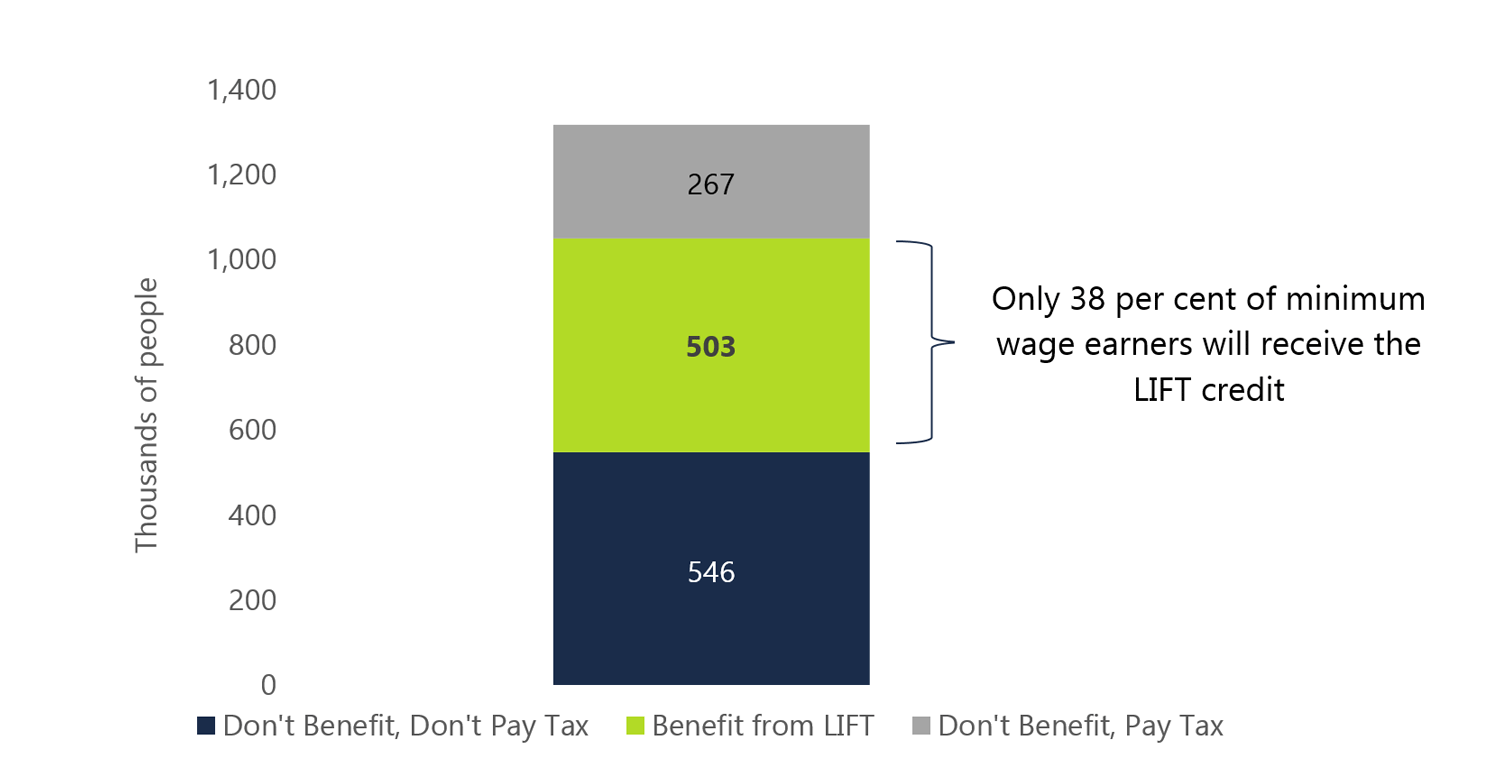

The FAO estimates that about 60 per cent of minimum wage earners, or about 800,000 individuals, will not receive the LIFT credit. Two-thirds of these individuals will not benefit from the LIFT credit because they already do not pay Ontario personal income tax, while the remaining individuals (one-third) are excluded because their individual or family income exceeds the threshold for the LIFT credit.

Source: FAO analysis of Statistics Canada’s Labour Force Survey (January-December 2018) and Social Policy Simulation Database and Model.

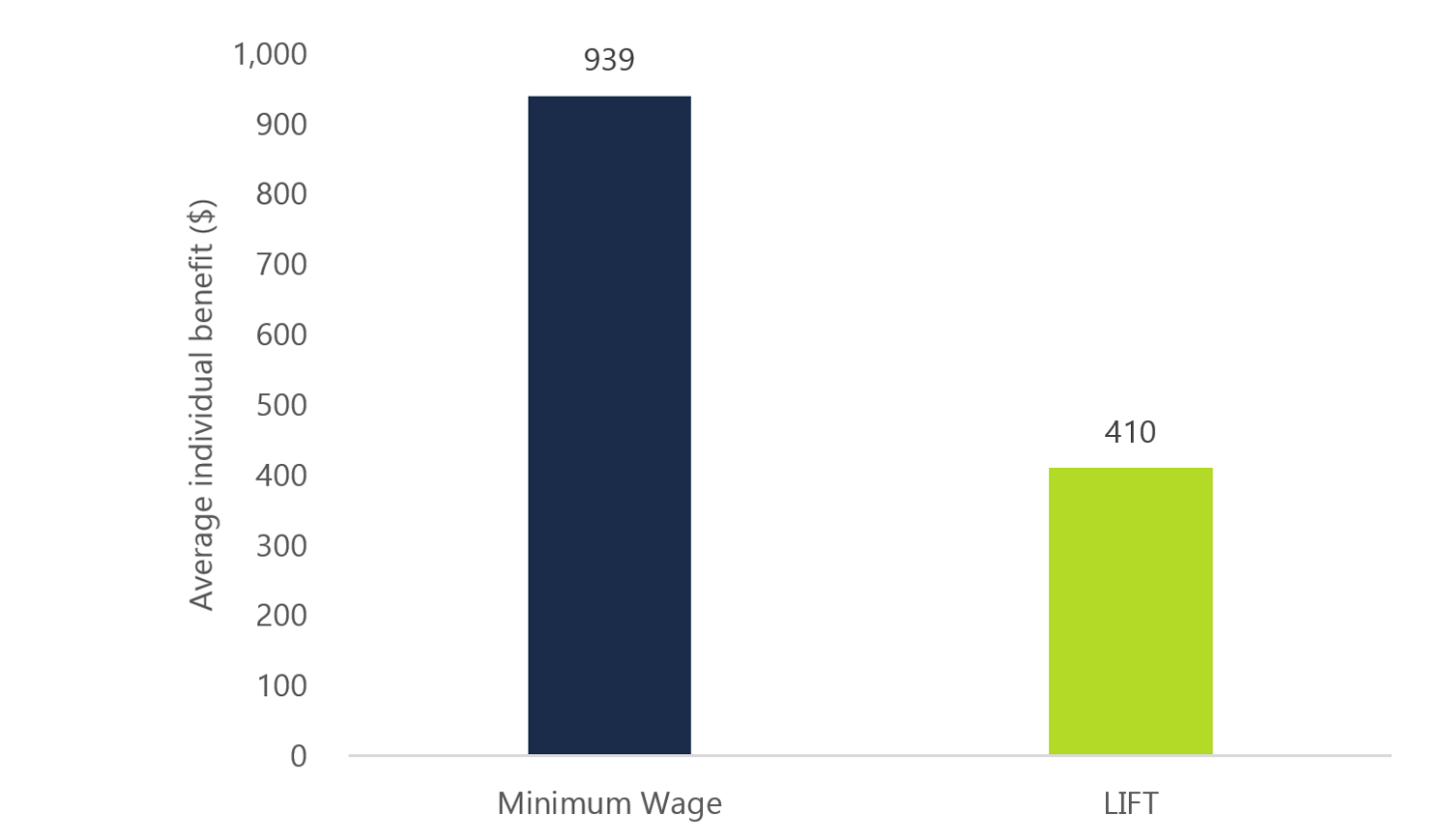

Minimum wage earning LIFT recipients will receive fewer benefits

The FAO estimates that about 503,000 minimum wage earners will receive the LIFT credit, for an estimated average LIFT credit of $410. The $410 average LIFT credit is lower than the estimated average benefit of $939 that would have been received by the same 503,000 minimum wage earners if the minimum wage had increased from $14 per hour to $15 per hour.

Minimum wage earners that receive the LIFT credit would have been better off with an increase in the minimum wage to $15 per hour

Source: FAO analysis of Statistics Canada’s Labour Force Survey (January-December 2018) and Social Policy Simulation Database and Model.

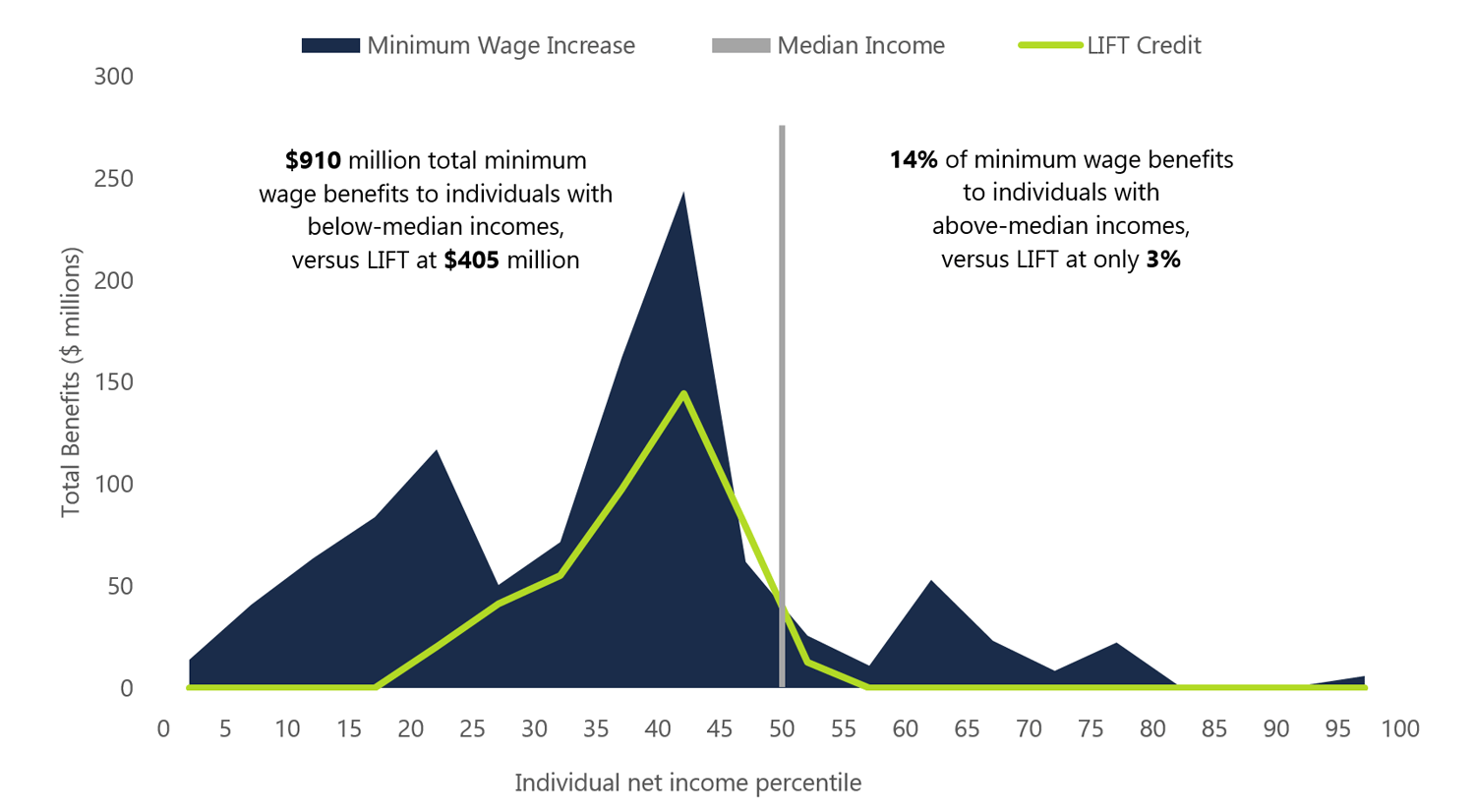

LIFT better targets individuals with below-median incomes

An increase in the minimum wage from $14 per hour to $15 per hour would have provided more aggregate benefits to individuals with below-median incomes[20] compared to the LIFT credit. However, on a relative basis, the LIFT credit provides a greater portion of its overall lower benefits to individuals with below-median incomes compared to the minimum wage increase. In other words, the LIFT credit better targets individuals with below-median incomes.

Overall, the FAO estimates that an increase in the minimum wage to $15 per hour would have provided $910 million in benefits to individuals with incomes of $36,000 or less, or 86 per cent of the total benefits. The LIFT credit will provide $405 million in benefits to these individuals, or 97 per cent of the total benefits.

Distribution of total minimum wage and LIFT benefits by individual net income percentiles

Note: This chart shows the benefit distribution only for individuals with positive net income. The FAO estimates the median net income for these individuals at about $36,000 in 2019.

Source: FAO analysis of Statistics Canada’s Labour Force Survey (January-December 2018) and Social Policy Simulation Database and Model.

Both the LIFT credit and minimum wage increase do not target low-income families

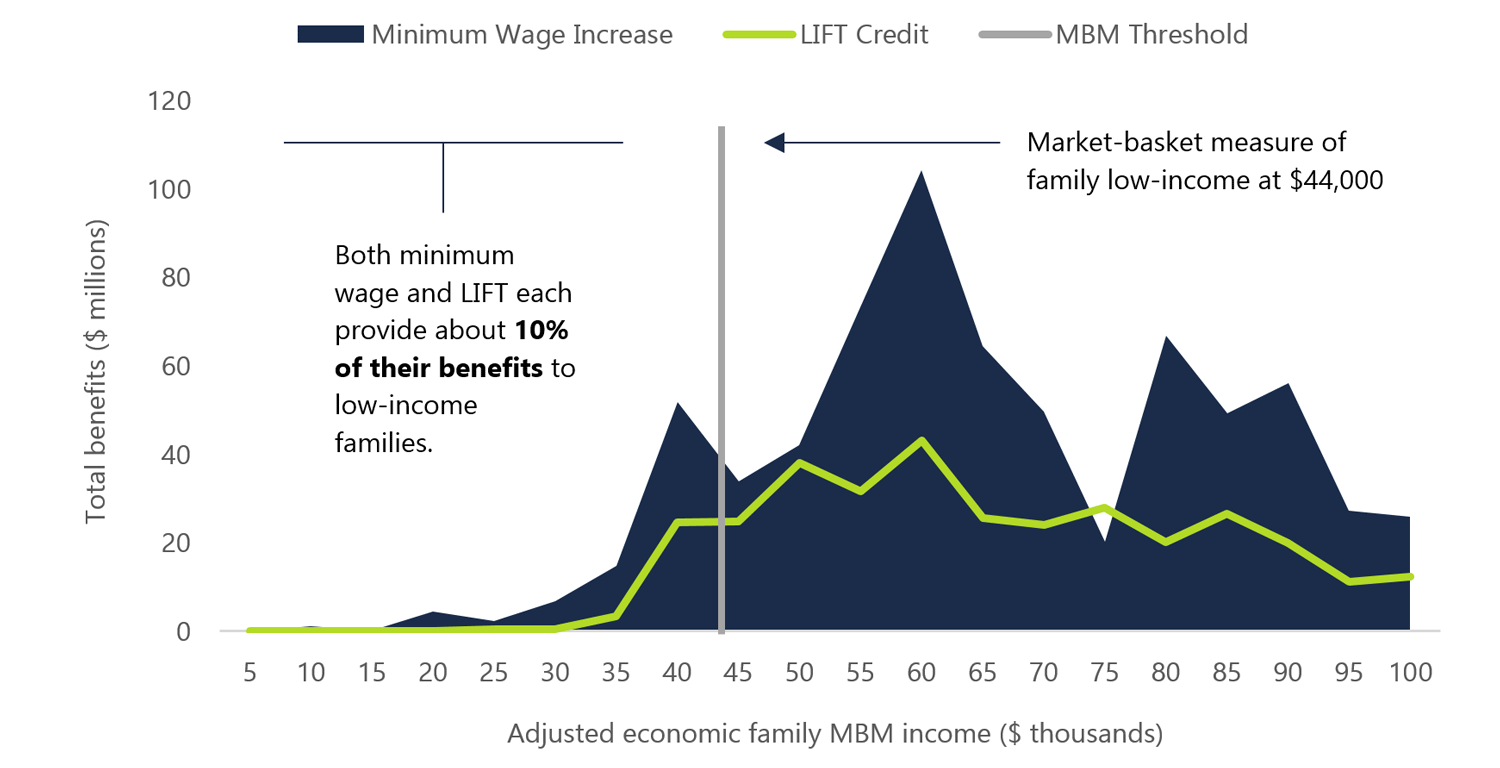

While both the minimum wage increase to $15 per hour and the LIFT credit target individuals with below-median incomes reasonably well (see above) both policy options provide limited support to low-income families.[21] For example, the FAO estimates that both an increase in the minimum wage to $15 per hour and the LIFT credit would have provided about 10 per cent of their respective benefits to individuals in low-income families.

Distribution of total minimum wage and LIFT benefits by adjusted economic family income

Note: MBM denotes the market-basket measure of low-income for an economic family size of four. The FAO estimates the MBM threshold at about $44,000 for an economic family of four in Ontario in 2019. The FAO has adjusted its estimate of economic family MBM income by family size. This chart shows about 75 per cent and 65 per cent of the total benefits for the LIFT credit and minimum wage increase, respectively, as the remainder is attributed to families with adjusted economic MBM incomes above $100,000 in 2019.

Source: FAO analysis of Statistics Canada’s Labour Force Survey (January-December 2018) and Social Policy Simulation Database and Model.

Economic Considerations

The FAO did not undertake a review of the macroeconomic effects of replacing the minimum wage increase with the LIFT credit as both policies will have a limited impact on overall economic activity. However, the FAO offers the following considerations:

- Increasing the minimum wage would redistribute income from business owners to workers. As a result, businesses would be expected to respond to higher payroll costs by raising prices and rationalizing their operations, creating some disemployment effects and increasing prices. However, despite these negative effects, the FAO estimates that an increase in the minimum wage would still lead to a real gain in labour income.[22]

- Overall, the LIFT credit provides fewer total benefits to Ontarians than an increase in the minimum wage. However, given that LIFT does not impose direct costs on businesses, the LIFT credit would have no disemployment effects and no direct impact on prices when compared to an increase in the minimum wage.

About this Commentary

This analysis is based on Statistics Canada’s Labour Force Survey (January-December 2018) and Statistics Canada’s Social Policy Simulation Database and Model (SPSDM). The assumptions and calculations underlying the simulation results were prepared by the Financial Accountability Office of Ontario and the responsibility for the use and interpretation of these data is entirely that of the authors. Details of the FAO’s methodology is available upon request.

External reviewers provided comments on early drafts of this report. The assistance of external reviewers implies no responsibility for the final product, which rests solely with the FAO.

Matt Gurnham

Director

mgurnham@fao-on.org

Matthew Stephenson

Senior Financial Analyst

mstephenson@fao-on.org

Jeffrey Novak

Chief Financial Analyst

jnovak@fao-on.org

With a contribution from Luan Ngo.

Financial Accountability Office of Ontario

2 Bloor Street West, Suite 900

Toronto, Ontario M4W 3E2

Media queries, contact: Kismet Baun, 416.254.9232 or email kbaun@fao-on.org.

About the FAO

Established by the Financial Accountability Officer Act, 2013, the Financial Accountability Office (FAO) provides independent analysis on the state of the Province’s finances, trends in the provincial economy and related matters important to the Legislative Assembly of Ontario. Visit our website at http://www.fao-on.org/en/ and follow us on Twitter at https://twitter.com/InfoFAO.

[1] 2018 Ontario Economic and Fiscal Review, p. 61 and Taxation Act, 2007, s. 21.1.

[2] Employment Standards Act, 2000, s. 23.1(1).

[3] Employment Standards Act, 2000, s. 23.1(4).

[4] The FAO’s estimate of forgone personal income tax revenue does not include any “spillover” effects that could have resulted from higher wages for workers earning just above $15 per hour. See footnote 18 for more analysis.

[5] The 2018 Fall Economic Statement did not provide a forecast for foregone provincial income tax revenue from cancelling the minimum wage increase.

[6] Taxation Act, 2007, s. 23 (1).

[7] The rebate of 5.05 per cent of employment income is equal to the Ontario provincial tax rate on taxable income under $43,906.

[8] An individual working 2,080 hours at $14 per hour would earn approximately $29,120 of employment income and pay $849 of Ontario personal income tax.

[9] The LIFT credit cannot rebate the Ontario Health Premium. The Ontario Health Premium is paid by Ontario residents through the income tax system. See https://www.ontario.ca/page/health-premium for Ontario Health Premium tax rates.

[10] Unless otherwise stated, “income” in this report refers to adjusted net income which is defined as total income minus allowable deductions and is line 236 on the T1 tax return.

[11] The benefit is reduced by the greater of 10 per cent of adjusted individual net income above $30,000 or 10 per cent of family net income over $60,000. Family net income for the purposes of the LIFT credit is defined as the combined adjusted net income of an individual and their spouse.

[12] The FAO defines “employed individuals” as individuals that earn more than $1,000 of employment income.

[13] On a household basis, rather than individual, the LIFT credit will provide an average rebate of $508 to 823,000 Ontario households.

[14] In the 2018 Fall Economic Statement (p. 61), the Province estimates that about 1.1 million Ontarians will receive an average benefit of about $450 from the LIFT credit.

[15] There are 301,000 individuals who will receive the maximum available benefit based on their adjusted net income up to $38,500.

[16] 2018 Ontario Economic and Fiscal Review, p. 61. More specifically, the Province claimed that Ontario personal income tax would be eliminated for 580,000 taxpayers and that 90 per cent of Ontario tax filers with incomes below $30,000 would pay no Ontario personal income tax.

[17] 2018 Ontario Economic and Fiscal Review, p. 61.

[18] The FAO estimates Ontarians would have received a total wage increase of $1.3 billion from increasing the minimum wage to $15 per hour from $14 per hour but estimates incremental provincial and federal taxes of $54 million and $148 million, respectively. This results in a net benefit to individuals of $1.1 billion, after taxes. In addition, increasing the minimum wage to $15 per hour could have led to “spillover” effects that would have resulted in higher wages for workers earning just above the new minimum wage. See: David Neumark, Mark Schweitzer, William Wascher, “The Effects of Minimum Wages Throughout the Wage Distribution”, February 2000. The FAO estimates that an increase in the minimum wage to $15 per hour would have led to an additional total wage increase of $0.6 billion and a total net after-tax benefit increase of $0.5 billion due to spillover effects.

[19] The FAO defines net benefit as the after-tax income or credit that individuals will receive from either the increase to the minimum wage or the LIFT credit.

[20] The FAO estimates median individual net income at about $36,000 for 2019 – for those with positive net income.

[21] In this report, the FAO defines low-income as economic families with incomes below the market-basket measure (MBM). The MBM refers to the measure of low income based on the cost of a specific basket of goods and services representing a modest, basic standard of living developed by Employment and Social Development Canada (ESDC). In 2019, the FAO estimates the MBM threshold at about $44,000 for an economic family of four in Ontario, which is about half of the median family income. The FAO estimates there are 1.1 million individuals in Ontario (or 10 per cent of Ontarians) that are part of families with incomes below the MBM threshold.

[22] See Financial Accountability Office, “Assessing the Economic Impact of Ontario's Proposed Minimum Wage Increase”, 2017.

35 per cent of 2.9 million eligible individuals will receive the LIFT credit

This chart shows that 2.9 million Ontarians are eligible to receive the LIFT credit. It shows that 1.5 million of these individuals will not receive the LIFT credit because these individuals do not pay Ontario income tax, and 0.4 million are excluded due to high family income. It shows that 1.0 million individuals, or 35 per cent of eligible individuals, will receive the LIFT credit.

Average individual LIFT credit by employment income

This chart shows the average individual LIFT credit by different ranges of employment income, which are $243 for the $0 to $20,000 range, $541 for the $20,001 to $30,000 range, $443 for the $30,000 to $38,500 range, and $409 for all LIFT credit recipients.

Maximum and average individual 2019 LIFT credit

This chart shows the maximum versus average LIFT benefit for individuals with incomes over the range of $16,000 to $38,500. It shows a constant maximum benefit of $850 over the income range of $16,000 to $30,000, then declining from $850 for incomes greater than $30,000, with zero benefits for individuals with incomes at $38,500. The average benefit is well below the maximum for individuals with incomes of $16,000 but increases towards the maximum for incomes between $16,000 to $30,000. Thereafter, the average benefit is very close to the maximum benefit.

LIFT credit recipients’ provincial taxes will be reduced significantly

This chart shows the average personal provincial income tax reduction due to the LIFT credit for individuals at different income ranges. It shows a $171 reduction for individuals earning between $0 and $20,000, a $537 reduction for individuals earning between $20,001 and $30,000, a $376 reduction for individuals earning between $30,001 and $38,500, and a $409 reduction for all individuals. The chart also shows that LIFT will reduce 95 per cent of provincial income taxes for individuals earning less than $30,000 and reduce 67 per cent of provincial income taxes for all LIFT recipients.

Comparison of benefits between minimum wage increase and LIFT credit

This chart shows the total benefits, total number of beneficiaries, and average individual benefit for both the increase to the minimum wage and the LIFT credit, which are $1,065 million and $418 million, 1,316 thousand and 1,021 thousand, and $810 and $409, respectively.

The minimum wage earners who will receive the LIFT credit

This chart shows that of the 1,316 thousand minimum wage earners, 546 thousand will not benefit from the LIFT credit because they don’t pay tax, 267 thousand will not benefit because their individual or family income is above the threshold for the LIFT credit, and 503 thousand, or 38 per cent of minimum wage earners, will receive the LIFT credit.

Minimum wage earners that receive the LIFT credit would have been better off with an increase in the minimum wage to $15 per hour

This chart shows the average individual benefit for minimum wage earners that receive the LIFT credit. It shows that these individuals would have received $939 from the minimum wage increase versus receiving $410 from the LIFT credit.

Distribution of total minimum wage and LIFT benefits by individual net income percentiles

This chart shows the distribution of the benefits for both the minimum wage increase and the LIFT credit for individuals ranked by adjusted net income percentile. It shows that $910 million and $405 million of the minimum wage increase and LIFT benefits, respectively will accrue to individuals with below-median incomes. It also shows that 14 per cent and 3 per cent of the minimum wage increase and LIFT credit benefits, respectively will accrue to individuals with above-median incomes.

Distribution of total minimum wage and LIFT benefits by adjusted economic family income

This chart shows the distribution of the benefits, in millions, for both the minimum wage increase and the LIFT credit for economic families ranked by the adjusted market-basket measure of income. It shows the market-basket measure of low-income threshold at $44,000, and it shows that both the minimum wage increase and the LIFT credit each provide about 10 per cent of their benefits to economic families below this low-income threshold.